6M

...

In an era where market diversification is key, Bitcoin shines as a must-have asset for forward-thinking investors. Its unique qualities of decentralization and limited supply offer a hedge against inflation and market volatility. Unlike traditional investments, Bitcoin operates on a global scale, unbound by government policies, offering investors a slice of digital autonomy. Its impressive track record over the past decade reveals a pattern of recovery and growth, highlighting its resilience and potential as a long-term investment.

Adding Bitcoin to your portfolio could signify a strategic move towards financial diversity and innovation. As the digital economy expands, Bitcoin is not merely an alternative asset; it’s a digital gold rush, redefining wealth storage for the 21st century. By aligning with Bitcoin, investors are not just following a trend; they are participating in a financial revolution that promises to reshape our concept of money and investments.

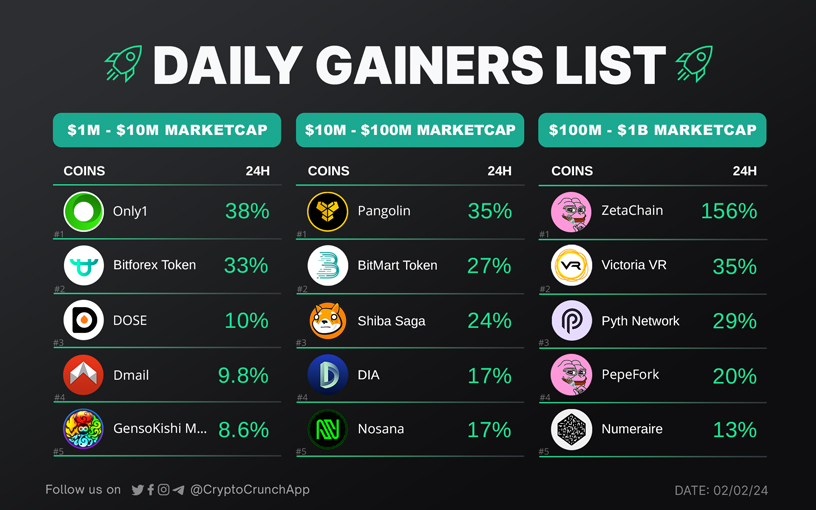

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join