7M

...

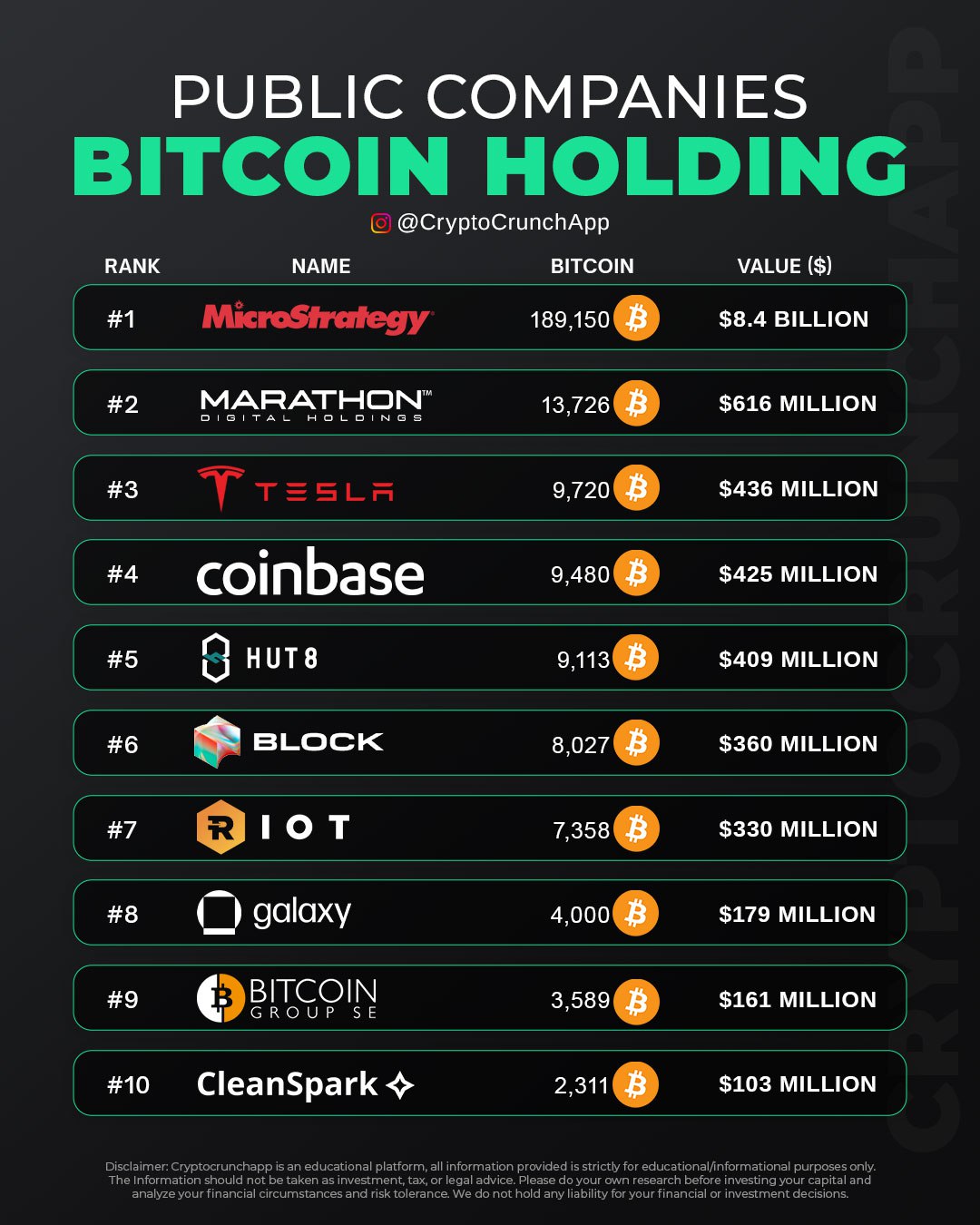

In an era where digital currencies are reshaping financial paradigms, public companies have started to adopt Bitcoin as a strategic asset, underscoring its growing acceptance beyond individual investors. A recent snapshot reveals MicroStrategy at the forefront, holding a staggering 189,150 Bitcoins valued at approximately $8.4 billion, establishing itself as the apex corporate holder of this cryptocurrency. Not far behind, Marathon Digital Holdings and Tesla Inc. have also embarked on substantial Bitcoin endeavors, with holdings of 13,726 and 9,720 Bitcoins, respectively, translating to valuations of $616 million for Marathon and $436 million for Tesla.

Coinbase, a platform synonymous with cryptocurrency transactions, holds 9,480 Bitcoins worth around $425 million, demonstrating a significant vested interest in the currency’s stability and growth. Other notable entities include Hut 8, Block, Riot, Galaxy, Bitcoin Group SE, and CleanSpark, each holding between 2,311 to 9,113 Bitcoins, with respective values ranging from $103 million to $409 million.

These investments represent a significant endorsement of Bitcoin’s potential as a reserve asset and raise intriguing questions about the future interplay between traditional corporate finance and digital assets. With Bitcoin’s inherent volatility, these companies navigate uncharted waters, leveraging potential rewards against discernible risks, a testament to their innovative spirit and foresight in an increasingly digital-centric economy.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join