4M

...

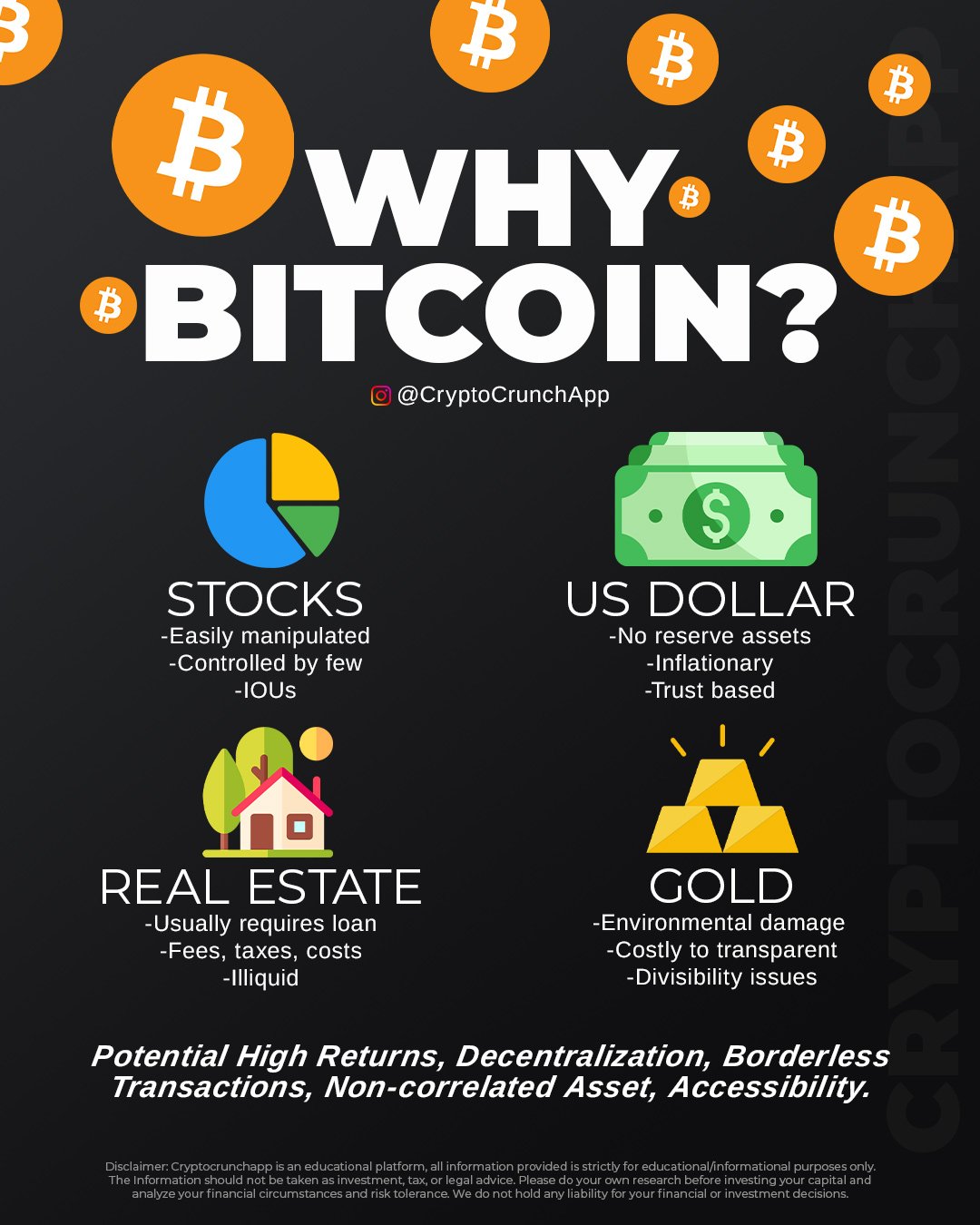

Bitcoin is increasingly considered a viable investment compared to traditional assets such as stocks, the US dollar, real estate, and gold. Each of these traditional assets has its limitations which Bitcoin aims to overcome.

Stocks are often criticized for being easily manipulated and controlled by a few, potentially making them less secure for individual investors. They are also seen as IOUs rather than tangible assets.

The US Dollar, while globally recognized and used, lacks reserve assets, is subject to inflation, and operates on a trust-based system, which can be vulnerable to economic fluctuations and policy changes.

Real Estate, though a tangible asset, usually requires loans to purchase and comes with high fees, taxes, and liquidity issues, making it a cumbersome investment.

Gold is a classic store of value but comes with its drawbacks, including environmental damage from mining, high costs of transparency, and issues with divisibility which can complicate transactions.

Bitcoin, in contrast, offers potential for high returns and operates on a decentralized network, providing a borderless, non-correlated asset that is accessible to anyone with internet access. Its digital nature eliminates many of the physical and administrative hindrances associated with traditional assets, making it an attractive option for a digital and globalized economy.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join