2Y

...

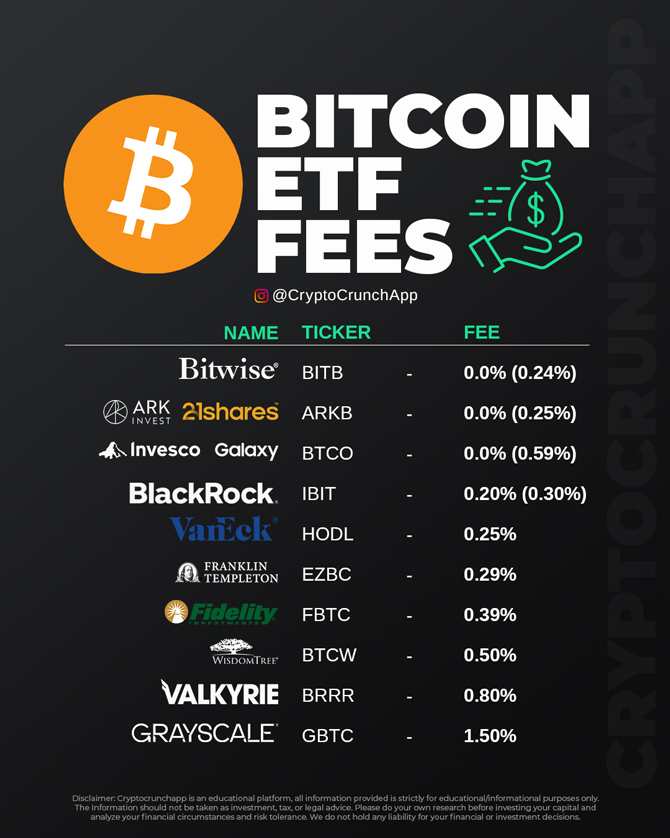

The financial terrain is witnessing an intriguing evolution with the advent of Bitcoin ETFs, offering investors a seamless conduit to the burgeoning world of cryptocurrency. This innovation heralds a significant shift, as entities like Bitwise (BITB) and Grayscale (GBTC) introduce products that amalgamate the volatility of digital assets with the stability of traditional investment vehicles. With fee structures as a critical differentiator, these funds vie for investor attention through varied cost implications.

For instance, Bitwise stands out with its nominal 0.0% (0.24%) fee, making it an attractive option for cost-conscious investors. Contrastingly, Grayscale’s GBTC commands a premium with a 1.50% fee, positioning itself for those perhaps seeking established market presence. Similarly, funds like Valkyrie (BRRR) and VanEck (HODL) offer a middle ground at 0.80% and 0.25% respectively, balancing cost with strategy.

These fees reflect the intricate strategies and operational costs inherent to managing such innovative investment products. They play a pivotal role in the decision-making process for investors, determining the accessibility and potential returns from these emergent financial instruments. As the Bitcoin ETF marketplace matures, the interplay between company reputation, fee structure, and investor appetite will undoubtedly shape its trajectory in the financial ecosystem.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join