1Y

...

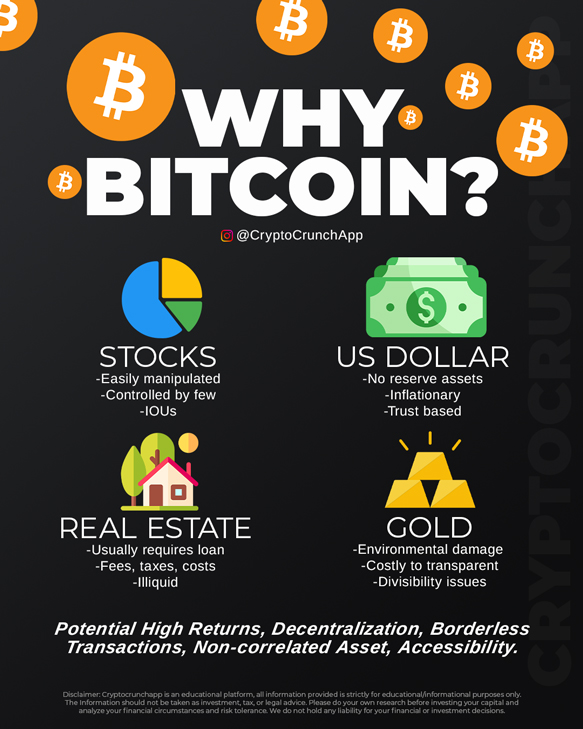

As the world veers towards digitization, Bitcoin emerges as a formidable force, challenging established financial norms. It offers a stark contrast to the volatility and centralized control that often plague stock markets. In lieu of the US dollar, which contends with inflation and a reliance on government backing, Bitcoin stands as a decentralized bastion with a predetermined scarcity, promising a hedge against fiscal erosion.

Real estate investments, once deemed secure, are laden with liabilities such as loans and substantial overheads, not to mention their inherent illiquidity. Bitcoin counters these drawbacks with unparalleled liquidity and lower barriers to entry, thereby democratizing the realm of investment. While gold has historically signified stability, its environmental footprint and divisibility issues are increasingly at odds with contemporary values. Conversely, Bitcoin’s digital nature ensures precise divisibility and mobility, coupled with an increasing shift towards eco-friendly mining solutions.

Bitcoin advocates a new financial ethos, offering high returns, decentralization, seamless transactions, and market independence. It is not merely an asset but a movement towards financial autonomy and inclusivity, heralding a renaissance in the way we perceive and interact with wealth in the digital epoch.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join