7M

...

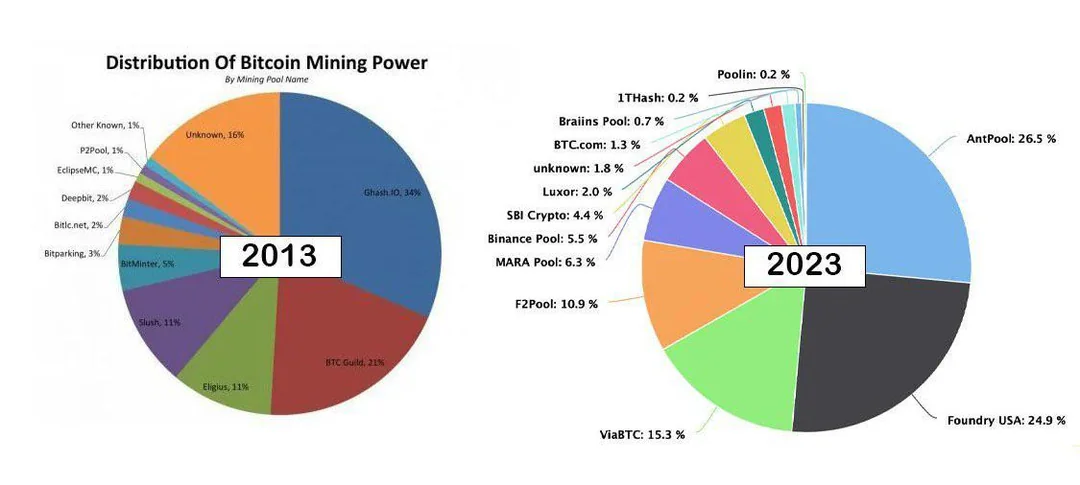

The landscape of Bitcoin mining has undergone a seismic shift over the last decade, as evidenced by the comparison of mining power distribution between 2013 and 2023. A pie chart from 2013 reveals a somewhat fragmented industry with a large portion of the mining power labeled as “unknown.” This suggests that a significant number of miners were individuals or small collectives, reflecting the relatively early stage of Bitcoin as a decentralized digital currency.

BTC Guild dominated the scene with a 21% share, followed by pools like Slush and Eligius, each holding 11%. The presence of many small players, such as BitMinter, Bitparking, and Deepbit, each with single-digit percentages, indicated a diverse mining environment. The “Other Known” section, accounting for 15%, combined with the 16% of unknown miners, painted a picture of a dispersed and less commercialized mining ecosystem.

Fast forward to 2023, and the pie chart tells a story of consolidation and commercialization. AntPool has emerged as the titan of the industry with a staggering 26.5% of the mining power. Close behind is Foundry USA, which controls nearly a quarter of the mining power, indicative of the rise in institutional and large-scale mining operations. The presence of these behemoths starkly contrasts the more egalitarian distribution of a decade ago.

Moreover, the “unknown” miners have dwindled to a mere 1.8%, showcasing the increased transparency and possibly the centralization of mining activities. This shift may also reflect the increasing difficulty and expense of mining Bitcoin, necessitating more substantial, more efficient operations.

The diversification within the remaining shares is less pronounced. While in 2013, the chart showed a kaleidoscope of players, the 2023 chart features fewer entities, each holding a more considerable portion of the mining power. Notable players like F2Pool and ViaBTC have maintained relevance with 10.9% and 15.3% respectively, which illustrates their ability to adapt and scale in a rapidly evolving market.

This comparison not only highlights the changing faces of Bitcoin mining pools but also underscores broader trends in the cryptocurrency space. It reflects the professionalization of the industry, the increasing influence of large-scale operations, and the impact of technological advancements that have made small-scale mining less viable.

In essence, these charts encapsulate a story of maturation within the Bitcoin ecosystem. They serve as a reminder that while Bitcoin’s ethos may remain rooted in decentralization, the reality of its mining operations has become increasingly centralized, with significant implications for the network’s security and governance.

Disclaimer: Market capitalizations can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join