1Y

...

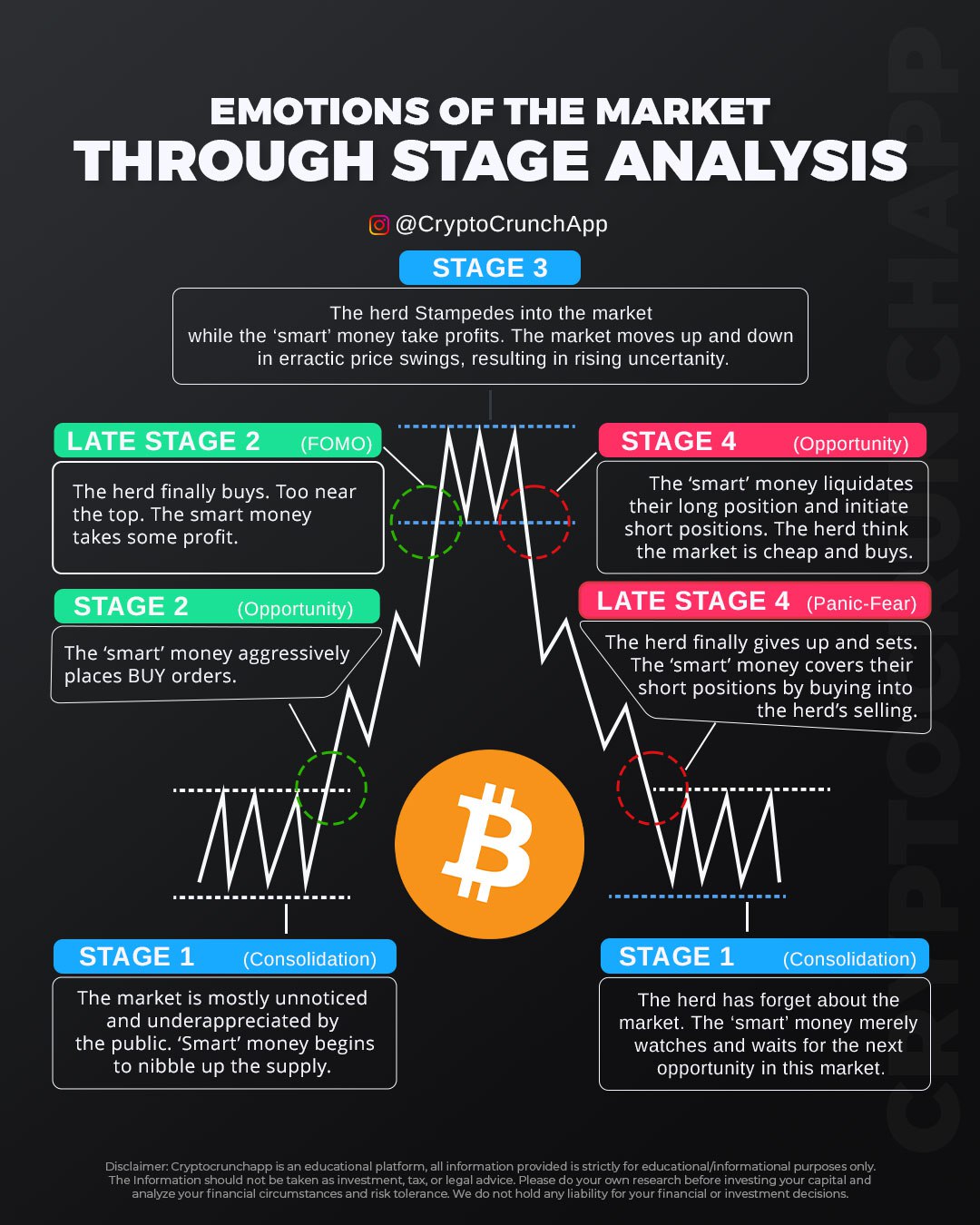

The intricate ebb and flow of Bitcoin’s market valuation can be mapped through a staged analysis of investor behavior. Initially, in Stage 1, Bitcoin attracts ‘smart money’—investors who recognize its long-term potential during periods of consolidation when the asset is undervalued and off the radar for the general public. This stage represents a foundational confidence in Bitcoin’s intrinsic value and the blockchain technology underpinning it.

As awareness grows, Stage 2 witnesses ‘smart money’ capitalizing on Bitcoin’s undervalued status, strategically placing buy orders. The subsequent increase in price garners media attention, thus luring more investors and propelling the market into Stage 3, where the ‘herd’—the mainstream investors driven by FOMO (Fear of Missing Out)—enter the market. This stage is characterized by heightened volatility and profit-taking by early investors.

Finally, Stage 4 unfolds as ‘smart money’ investors liquidate their positions to the ‘herd,’ now gripped by panic and fear. Astute investors may then re-enter at lower prices, completing the cycle. This staged approach to Bitcoin’s market sentiment underscores the complex interplay between investor behavior and asset value, reinforcing Bitcoin’s position as a dynamic component of the modern financial landscape.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join