1Y

...

In the evolving landscape of finance, Bitcoin emerges as a digital equivalent of gold, its scarcity underpinning its value. As we witness a shift in investment patterns with individuals opting for fractions of Bitcoin over whole units, the underlying message is clear: Bitcoin’s finite supply mirrors the scarcity that has historically bolstered gold’s appeal. With a hard cap of 21 million coins, Bitcoin’s design ensures that scarcity will only intensify over time, a feature that could potentially enhance its value proposition.

Looking ahead, the prospect of acquiring even 0.01 Bitcoin is anticipated to become significantly challenging, hinting at a trajectory where Bitcoin’s worth is poised to escalate. This scenario invites a strategic consideration of Bitcoin as a store of value, a hedge against inflation, and a means to diversify investment portfolios. Amidst the digital transformation, the question is not just about holding Bitcoin, but understanding its potential to redefine wealth accumulation for future generations.

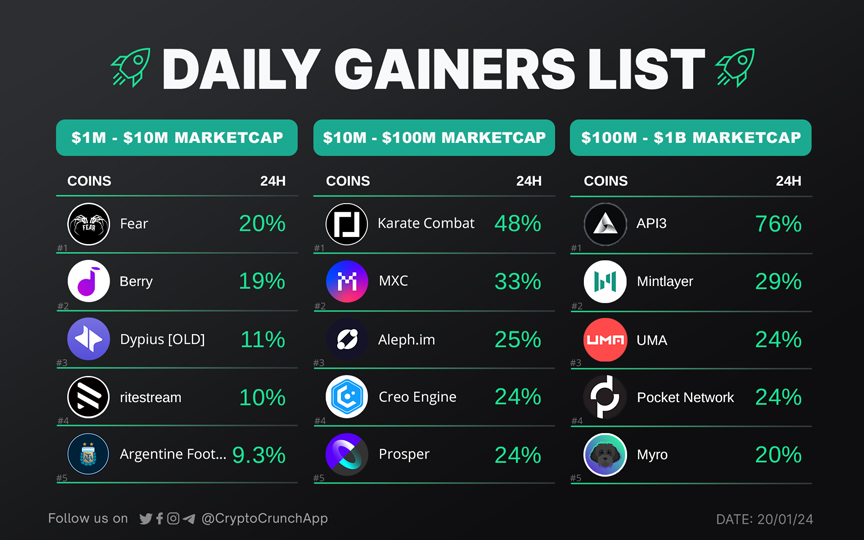

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join