2Y

...

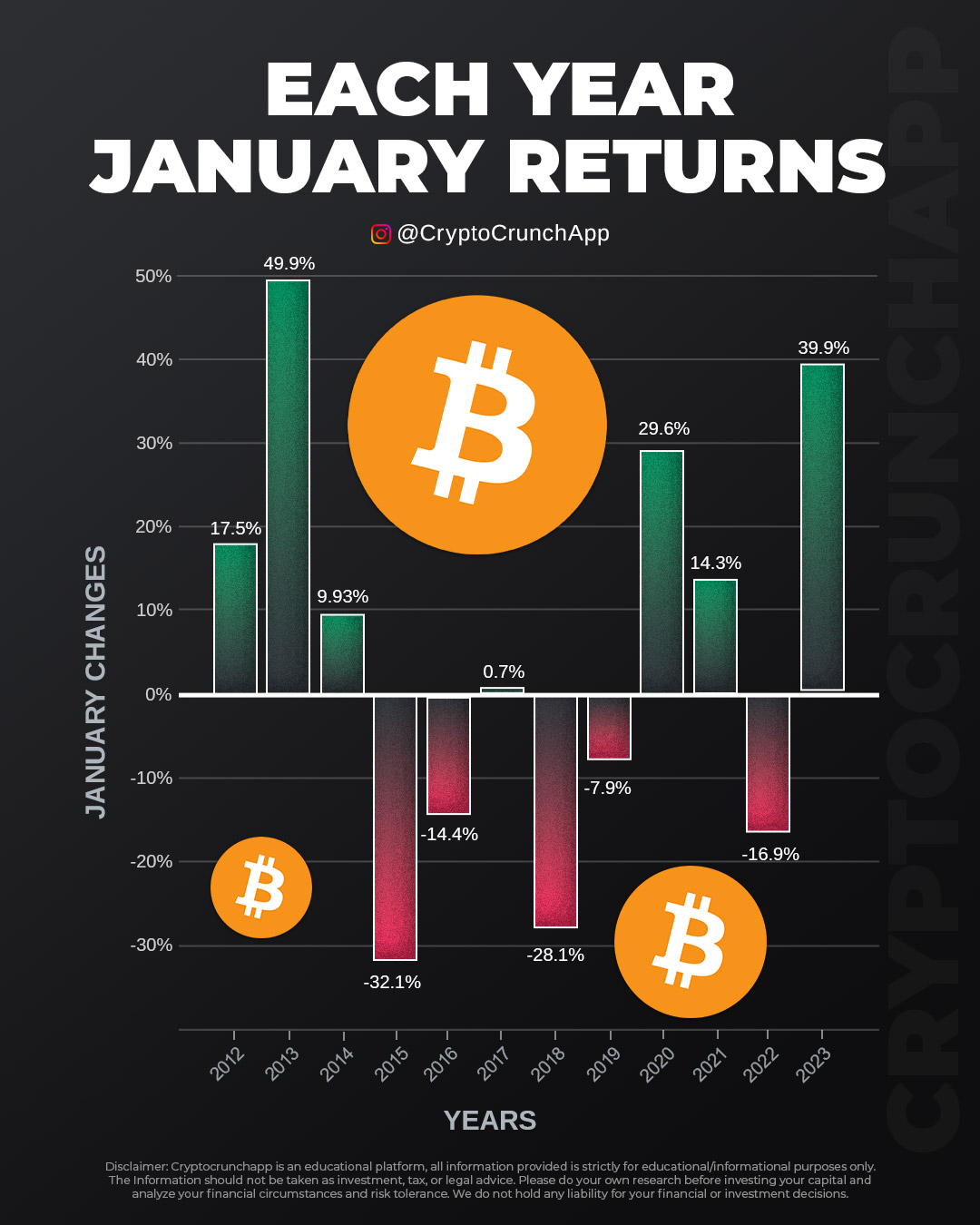

When it comes to investing in Bitcoin, January has historically been a month of wild rides. A bar graph analysis of the cryptocurrency’s performance from 2012 to 2023 reveals a pattern as erratic as it is exciting.

The years 2013 and 2023 stand out with soaring gains of 49.9% and 39.9%, respectively, painting a picture of a digital asset capable of delivering outstanding returns. These spikes in performance hint at the underlying potential of Bitcoin, an asset unbound by traditional financial systems, and governed by the free market’s pure supply and demand dynamics.

In contrast, years like 2015 and 2018 showcase significant dips, with January returns plummeting to -32.1% and -28.1%. However, even these downturns contribute to the narrative of Bitcoin as an asset for the bold—where there is risk, there is also the potential for reward.

Bitcoin’s volatile nature is not for the faint-hearted, yet for those willing to ride out its fluctuations, the graph suggests that January’s chill winds can bring a harvest of gains. The data illustrates not only Bitcoin’s capacity for recovery but also its resilience as an investment frontier that continues to attract the audacious and the visionary.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join