2Y

...

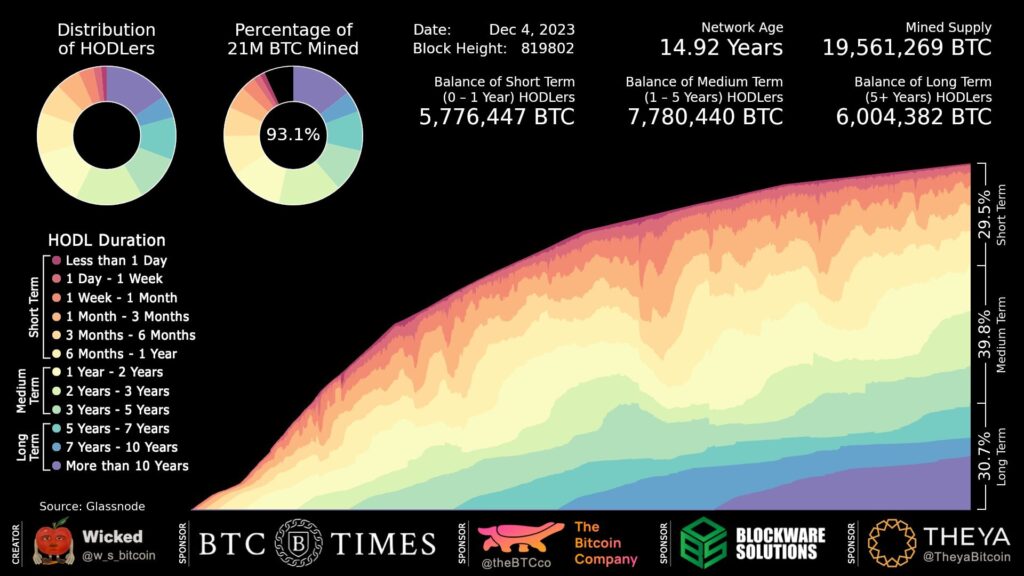

In a development that marks a significant shift in the cryptocurrency landscape, a recent report has shed light on a remarkable trend within the Bitcoin community. Over 30% of all Bitcoin in circulation has remained untouched for a staggering half a decade. This revelation comes from a comprehensive analysis of Bitcoin’s blockchain data, indicating a solidifying trend of long-term holding among Bitcoin investors.

The Essence of the Report

The report, accompanied by an insightful infographic, highlights that a substantial portion of Bitcoin, which amounts to millions in terms of supply, has not moved from its wallets for over five years. This is the first time in Bitcoin’s history that such a high percentage of its circulation has remained stationary for this long.

Understanding the HODL Mentality

The term “HODL,” born from a misspelled word in a popular Bitcoin forum, has come to represent a philosophy among cryptocurrency investors. It signifies holding onto the cryptocurrency through its notorious price volatility, with a belief in its future value. The data now shows that this is not just a popular saying but a strategy adopted by a significant portion of Bitcoin investors.

Breaking Down the Infographic

The infographic paints a clear picture of this trend. It categorizes Bitcoin holders based on the duration they have held the cryptocurrency. Remarkably, the segment that held Bitcoin for more than five years has grown steadily, now accounting for over 30% of the total Bitcoin in circulation.

Implications of This Trend

This trend has several implications for the Bitcoin market:

- Reduced Market Liquidity: With such a large portion of Bitcoin being held long-term, the liquidity in the market is reduced, potentially leading to increased volatility with smaller market movements.

- Price Stability in the Long Term: Conversely, the HODL trend could also lead to price stabilization as fewer Bitcoins are available for trading, reducing the impact of large sell-offs.

- Investor Confidence: This trend signifies a strong belief among investors in the future value of Bitcoin, viewing it as a long-term investment rather than a quick-profit opportunity.

- Maturity of the Market: The growing number of long-term holders suggests a maturing market with investors thinking beyond immediate gains.

Conclusion

The “HODL Revolution” indicates a significant shift in the mindset of Bitcoin investors. Moving away from the early days of speculative trading, the Bitcoin community is now seeing a more stable and mature investment approach. This could have lasting impacts on the cryptocurrency’s valuation and its perception as a digital asset. The report, with its detailed infographic, offers a comprehensive look into this new phase of Bitcoin’s evolution, marking it as not just a digital currency but a long-term asset in the investment world.

Join CryptoCrunchApp on Telegram Channels – Click to Join

Disclaimer: Market capitalizations can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.