2Y

...

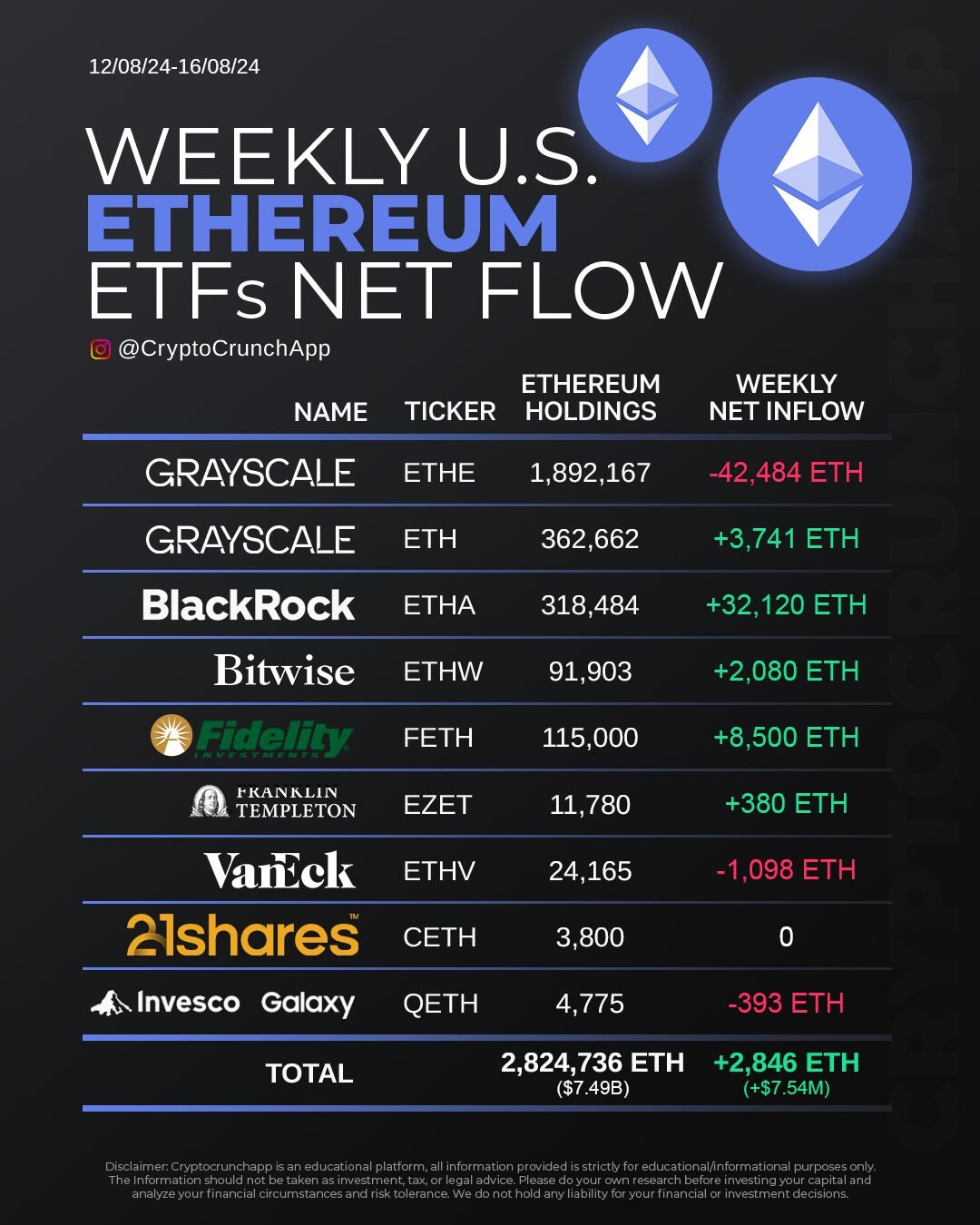

During the week spanning August 12 to August 16, 2024, U.S. Ethereum ETFs exhibited varied net flow activities, reflecting differing investor sentiments. Grayscale’s ETHE, holding a substantial 1,892,167 ETH, experienced the largest net outflow of the week at -42,484 ETH. Conversely, BlackRock’s ETHA saw a significant inflow, adding 32,120 ETH to its holdings of 318,484 ETH.

Other notable movements included Fidelity’s FETH, which gained 8,500 ETH, and Grayscale’s smaller ETH fund, which added 3,741 ETH. Bitwise’s ETHW also reported a positive net flow of 2,080 ETH.

However, not all funds experienced inflows. VanEck’s ETHV saw a reduction of 1,098 ETH, and Invesco Galaxy’s QETH had an outflow of 393 ETH. Franklin Templeton’s EZET had a modest increase, adding 380 ETH.

Overall, the total holdings for these U.S. Ethereum ETFs amounted to 2,824,736 ETH, with a net weekly inflow of 2,846 ETH, equivalent to a monetary increase of approximately $7.54 million, illustrating the dynamic nature of cryptocurrency investments within institutional frameworks.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join