2Y

...

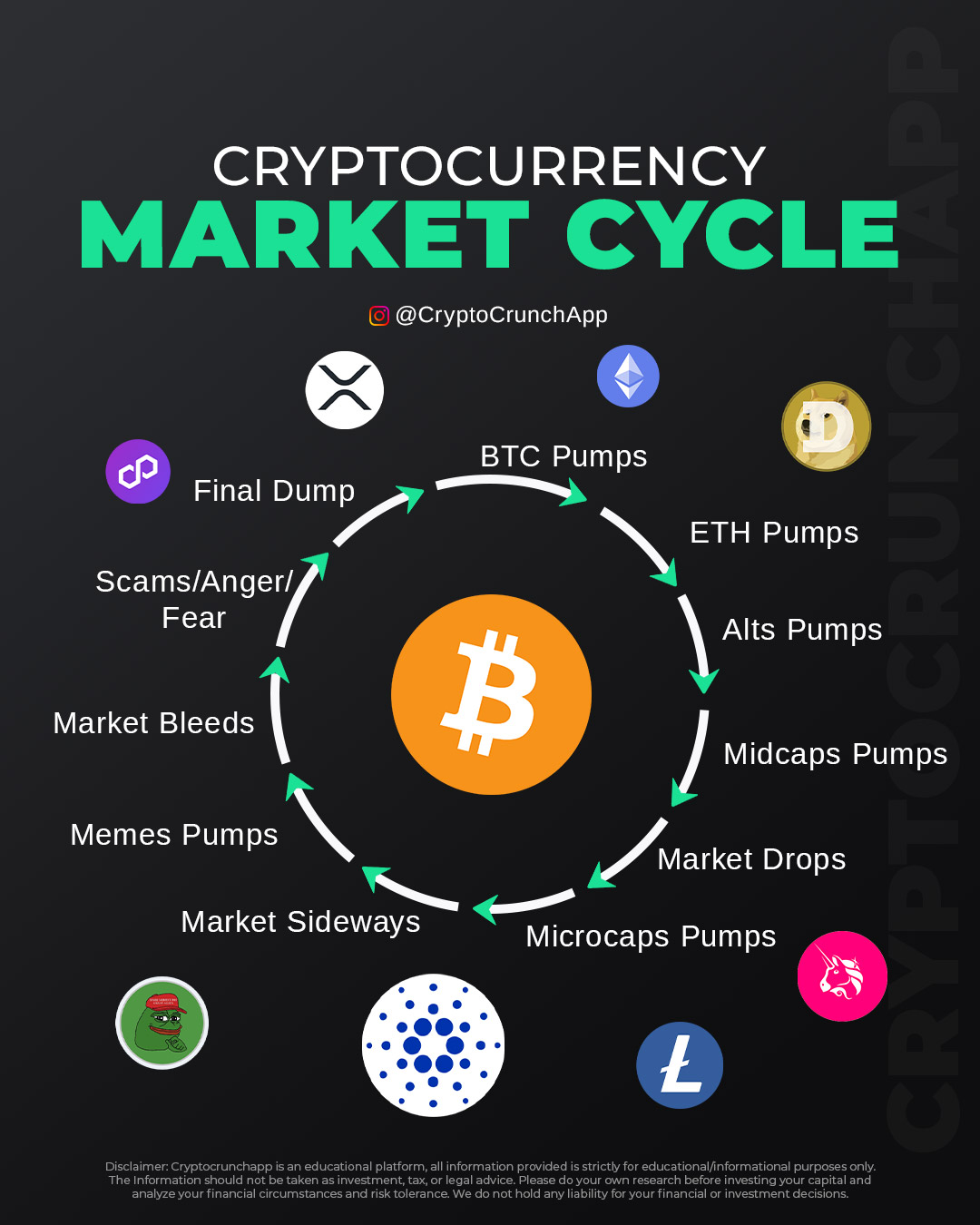

The Cryptocurrency Market Cycle: Understanding the Ups and Downs

The world of cryptocurrency is a dynamic and ever-evolving space, where fortunes can be made or lost in the blink of an eye. Understanding the market cycle of cryptocurrencies can be a powerful tool for anyone looking to navigate this space. The cycle not only reflects the fluctuating prices of digital assets but also the sentiments and behaviors of investors.

The Start of the Cycle: Bitcoin Pumps

The cycle often begins with Bitcoin (BTC), the progenitor and heavyweight of the crypto world. As Bitcoin’s price increases or “pumps,” it captures media attention and investor interest, spurring new investments into the market. This phase is characterized by optimism and can be driven by various factors, including technological advancements, positive regulatory news, or macroeconomic trends favoring digital currencies.

Ethereum and Altcoins Follow: The Ripple Effect

Following Bitcoin’s lead, Ethereum (ETH), with its broader application possibilities through smart contracts, begins to pump. This increase in Ethereum’s price often signals the start of a broader market rally. Subsequently, alternative coins (altcoins) and mid-cap cryptocurrencies start to experience price surges as well. This phase of the cycle is marked by a growing sense of confidence as a wider range of assets begins to benefit from the initial Bitcoin pump.

The Expansion: Microcaps and Memes

As the market heats up, even microcap coins, which are typically lower in market capitalization and more speculative, see an increase in price. This stage can also see the rise of meme coins, which may not have fundamental value but are driven by social media hype and community support. It’s a stage of exuberance, often detached from traditional valuation metrics.

The Peak: Market Sideways and the Inevitable Drops

After the excitement comes the plateau—often referred to as the market moving “sideways.” Here, prices stabilize, and the frenetic pace of increases slows down. It’s a period of consolidation, where the market catches its breath. Eventually, though, what goes up must come down. The market drops, sometimes triggered by negative news, profit-taking, or simply the cycle’s natural ebb and flow.

The Fallout: Midcaps and Altcoins Dump

The drop in prices isn’t limited to Bitcoin. Midcap cryptocurrencies, followed by altcoins, begin to lose value—often more rapidly and severely than Bitcoin. The decline in prices can lead to panic selling, further exacerbating the downturn.

The Final Phase: Market Bleeds, Scams, and Fear

In the final phase of the cycle, the market “bleeds.” It’s a time when the fears of a bear market take hold, sometimes accompanied by scams, hacks, or other negative events that can induce fear, anger, and a sense of betrayal among investors.

Rinse and Repeat: The Cycle Continues

Just like the seasons, this cycle is a natural part of the cryptocurrency ecosystem. After the fear and the fallout, the market eventually finds its footing, and the cycle begins anew. It’s important for investors to recognize that this cycle is driven by human emotion as much as market fundamentals.

Navigating the Cycle

Understanding this cycle can be incredibly beneficial. It reminds investors to be cautious when others are greedy and to consider opportunities when others are fearful. It emphasizes the importance of due diligence, the perils of hype, and the value of patience.

Conclusion

The Cryptocurrency Market Cycle is a pattern of human emotion as much as it’s a reflection of financial markets. By understanding its phases, investors can better prepare for the volatility inherent in crypto investing. While no one can predict the future, being aware of the cycle is the first step towards making informed decisions in the crypto market.

Remember, investing in cryptocurrencies is risky, and this guide is not investment advice but an educational tool to understand market dynamics. Always do your own research and consider your financial situation before investing.

Join CryptoCrunchApp on Telegram Channels – Click to Join

Disclaimer: Market capitalizations can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.