2Y

...

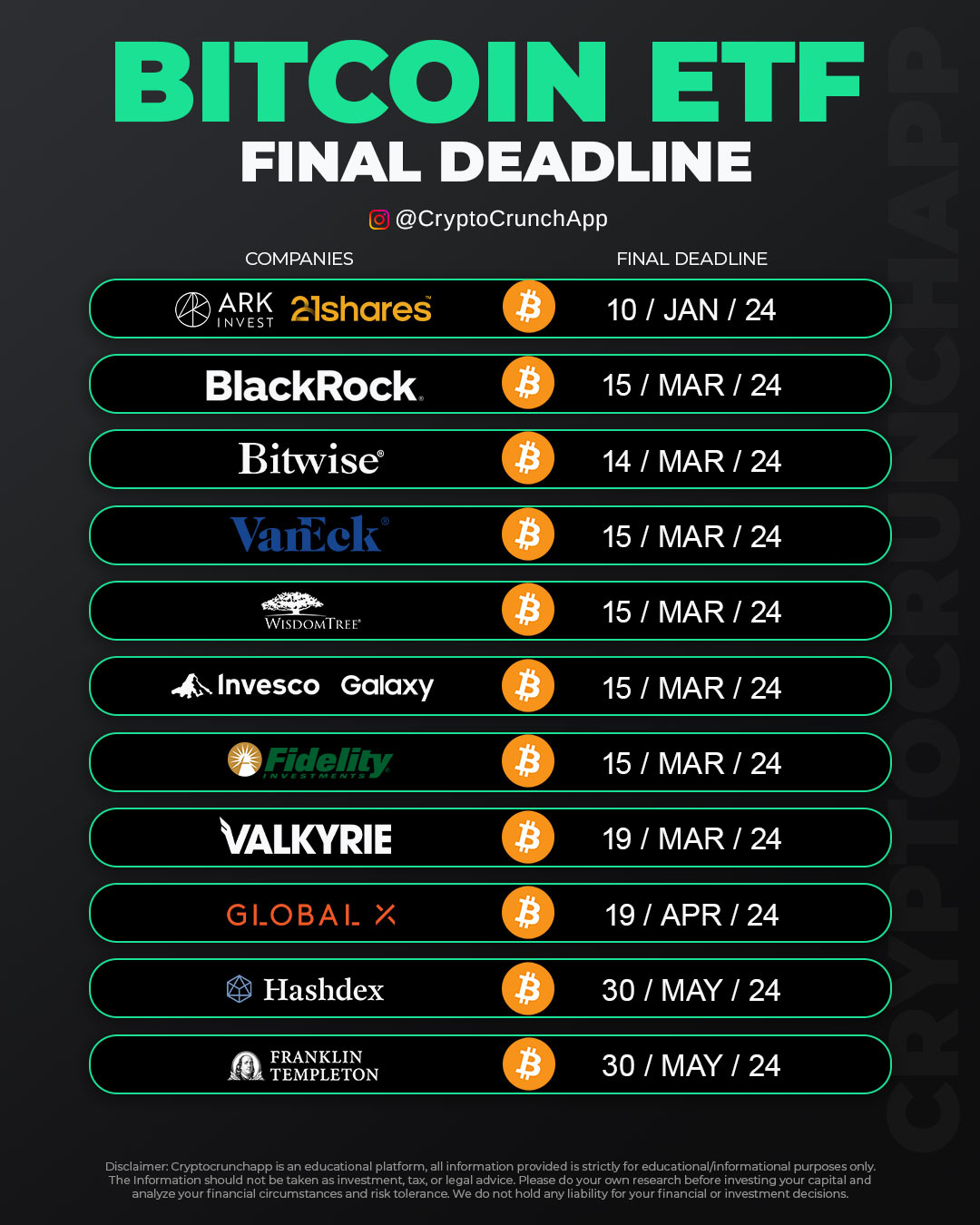

In the high-stakes arena of cryptocurrency, several investment heavyweights are on the cusp of potentially changing the investment landscape forever with the introduction of Bitcoin ETFs. These instruments promise to demystify Bitcoin investments, offering a traditional structure for those intrigued by digital currencies but wary of the complex and unregulated nature of typical crypto assets.

ARK Invest and 21shares have deadlines looming in January 2024, potentially leading the charge in this revolutionary shift. Close on their heels, BlackRock and Bitwise aim for March 2024, a month that is shaping up to be a watershed for Bitcoin ETF ambitions. Fidelity Investments, synonymous with trust and stability, is also in the mix, suggesting a new era of cryptocurrency integration into conventional portfolios.

As spring blossoms in April 2024, Valkyrie and Global X will have their strategies tested. By the end of May 2024, Hashdex and Franklin Templeton will conclude this period of anticipation. The outcomes of these deadlines will not just influence the future of these companies but could also signal a new epoch for cryptocurrency, possibly catapulting Bitcoin into the mainstream investment world.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join