1Y

...

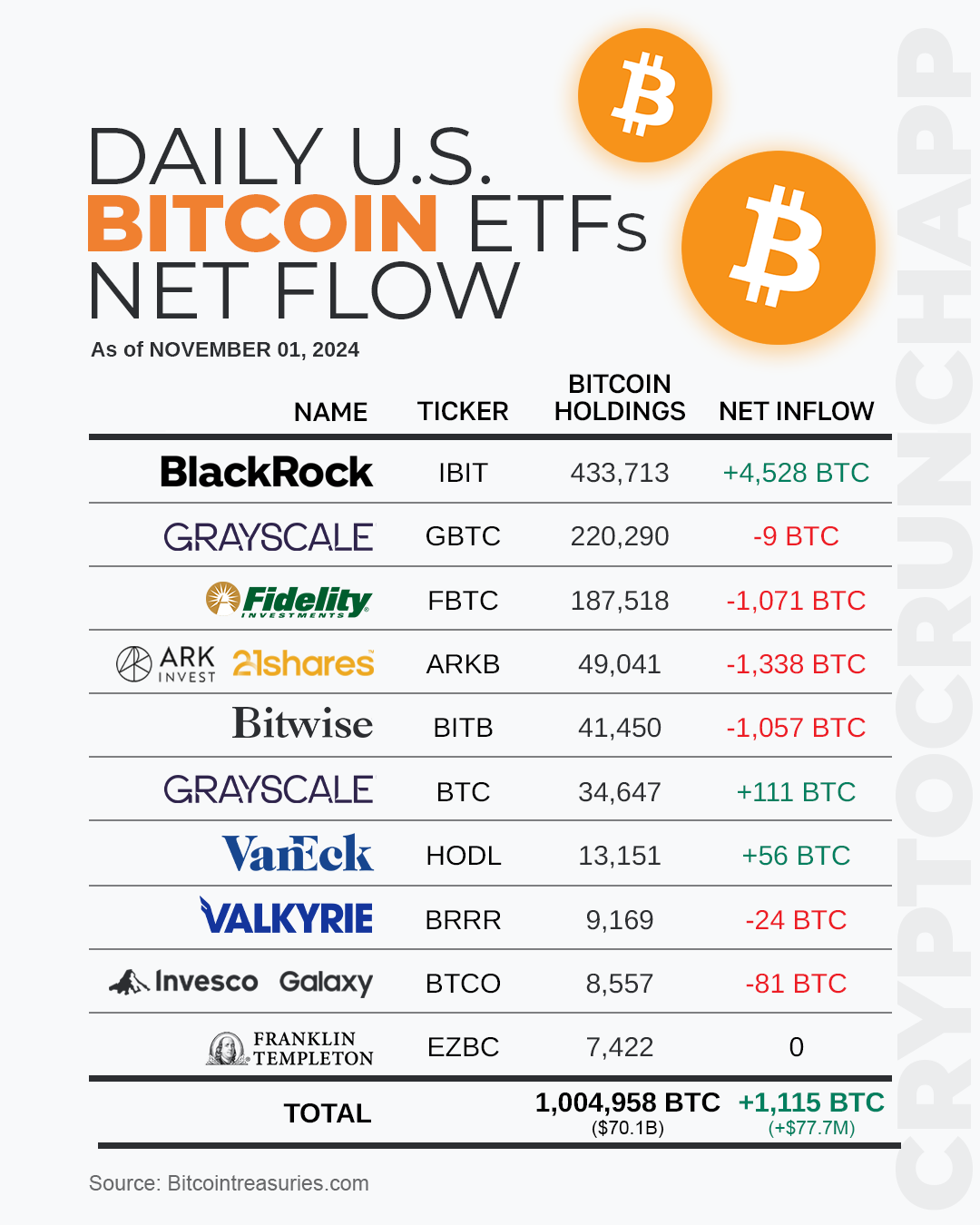

The daily net flow of U.S. Bitcoin ETFs on November 1, 2024, shows notable fluctuations across various funds. BlackRock’s Bitcoin ETF (Ticker: IBIT) led with a significant net inflow of 4,528 BTC, reflecting strong investor interest and increasing its total holdings to 433,713 BTC. In contrast, substantial outflows were observed in several other funds, with Fidelity’s Bitcoin ETF (Ticker: FBTC) experiencing the largest reduction, losing 1,071 BTC. ARK’s Bitcoin ETF (Ticker: ARKB) and Bitwise (Ticker: BITB) also faced significant outflows of 1,338 BTC and 1,057 BTC respectively.

Other funds saw more moderate changes. Grayscale’s Bitcoin ETF (Ticker: BTC) added 111 BTC, while VanEck’s (Ticker: HODL) gained 56 BTC. Valkyrie (Ticker: BRRR) and Invesco Galaxy (Ticker: BTCO) experienced minor decreases of 24 BTC and 81 BTC respectively.

Despite some notable outflows, the total Bitcoin holdings across all ETFs slightly increased to 1,004,958 BTC, with an overall net increase of 1,115 BTC for the day, amounting to a market value increase of approximately $77.7 million. This day’s transactions reflect a dynamic and shifting landscape in the U.S. Bitcoin ETF market, indicating diverse investor strategies and responses to market conditions.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join