2Y

...

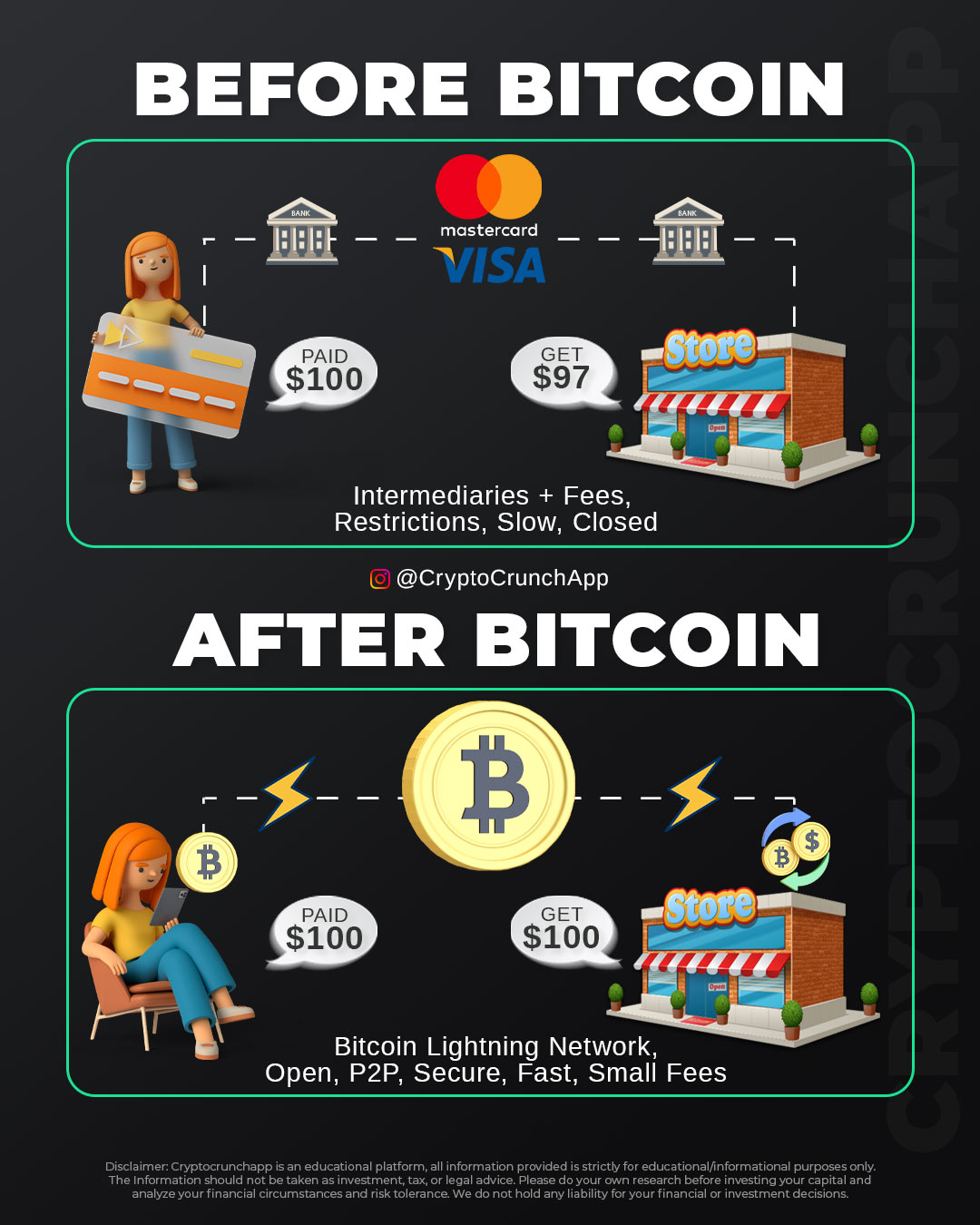

The evolution of financial transactions has seen a significant transformation with the advent of Bitcoin. Historically, traditional payment methods like credit cards have played a pivotal role in our everyday transactions. They serve as intermediaries between the buyer and seller, facilitating the transfer of funds with ease. However, this convenience comes with its own set of drawbacks, including transaction fees, processing delays, and numerous restrictions imposed by financial institutions.

In the conventional setup, a customer using a credit card for a purchase is subject to a range of fees that financial institutions levy for their services. For instance, if a customer pays $100, the merchant might only receive $97 after the deduction of fees. Moreover, these transactions are subject to the scrutiny and regulations of the banks and credit card companies, which can sometimes result in slower processing times and a lack of privacy for the users.

Bitcoin and its underlying technology, blockchain, have emerged as a game-changer in this scenario. Bitcoin, a decentralized digital currency, operates on the principles of an open, peer-to-peer (P2P) network. This network is bolstered by the Bitcoin Lightning Network, an innovation designed to make transactions faster and cheaper. When a customer pays with Bitcoin, the transaction bypasses traditional intermediaries, allowing the merchant to receive the full amount more swiftly and securely. The absence of a middleman translates to minimal fees, ensuring that if a customer pays $100, the merchant receives $100.

This shift is not just about reducing costs; it’s also about empowering users with more control over their transactions. Bitcoin’s P2P nature and the security of the Lightning Network provide users with a level of privacy and autonomy that traditional financial systems cannot offer. The transactions are secure, fast, and less restrictive, opening up a realm of possibilities for both customers and merchants alike.

The transition from traditional payment systems to Bitcoin represents a broader pattern of digital transformation in financial services. It signals a move towards more user-centric systems that prioritize efficiency, security, and accessibility. As the world becomes more interconnected, the appeal of a universal and decentralized currency like Bitcoin becomes increasingly evident.

Bitcoin’s impact on the payment ecosystem is profound. It challenges the status quo, pushing for a more equitable financial framework where the benefits are not disproportionately skewed towards the intermediaries. It’s a call for a financial revolution that champions transparency and fairness, one where every cent paid is a cent received.

In conclusion, Bitcoin’s approach to financial transactions is not just a technological advancement; it’s a paradigm shift in how we perceive and handle money. It represents the dawn of an era where the control of money is distributed among its users, rather than concentrated in the hands of a few. As we look towards the future, it becomes increasingly clear that Bitcoin and its innovative frameworks like the Lightning Network are not just alternative options but are paving the way for a new financial narrative.