1Y

...

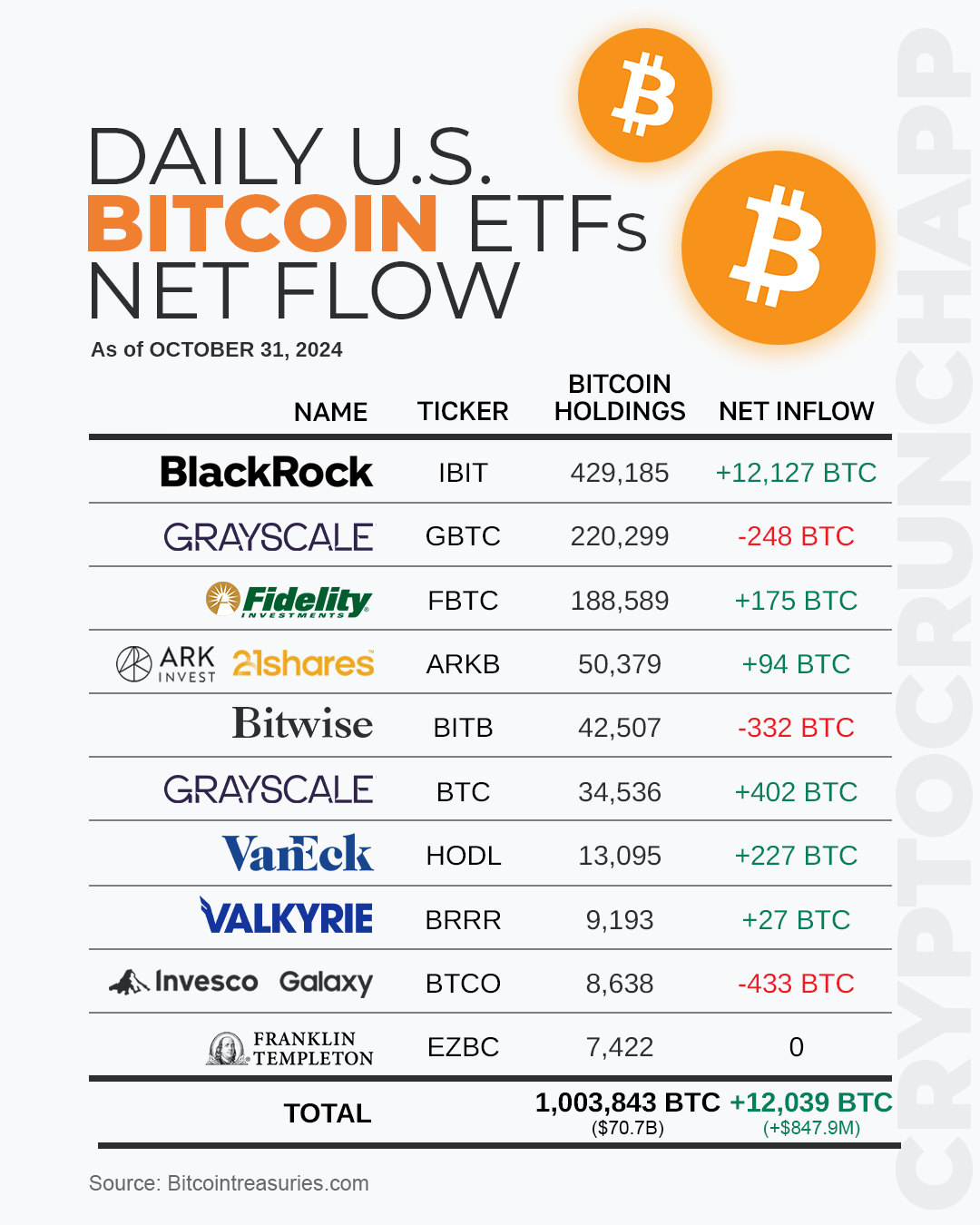

The daily net flow of U.S. Bitcoin ETFs on October 31, 2024, reflected significant activity, particularly from BlackRock’s Bitcoin ETF (Ticker: IBIT), which saw an impressive net inflow of 12,127 BTC. This marked a substantial increase, pushing the total Bitcoin holdings for BlackRock to 429,185 BTC. Other ETFs like Fidelity’s Bitcoin ETF (Ticker: FBTC) and VanEck’s (Ticker: HODL) also saw healthy gains, adding 175 BTC and 227 BTC respectively.

Conversely, there were notable outflows in several ETFs. Bitwise (Ticker: BITB) experienced a decline of 332 BTC, while Invesco Galaxy (Ticker: BTCO) saw a reduction of 433 BTC. Grayscale’s Bitcoin ETF (Ticker: GBTC) also faced a slight outflow, losing 248 BTC.

Overall, the total holdings across all ETFs surpassed the one million BTC mark, totaling 1,003,843 BTC, with a net increase of 12,039 BTC for the day, valued at approximately $847.9 million. This indicates a robust influx of capital into Bitcoin ETFs, highlighting growing investor confidence and interest in the cryptocurrency space on that particular day.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join