1Y

...

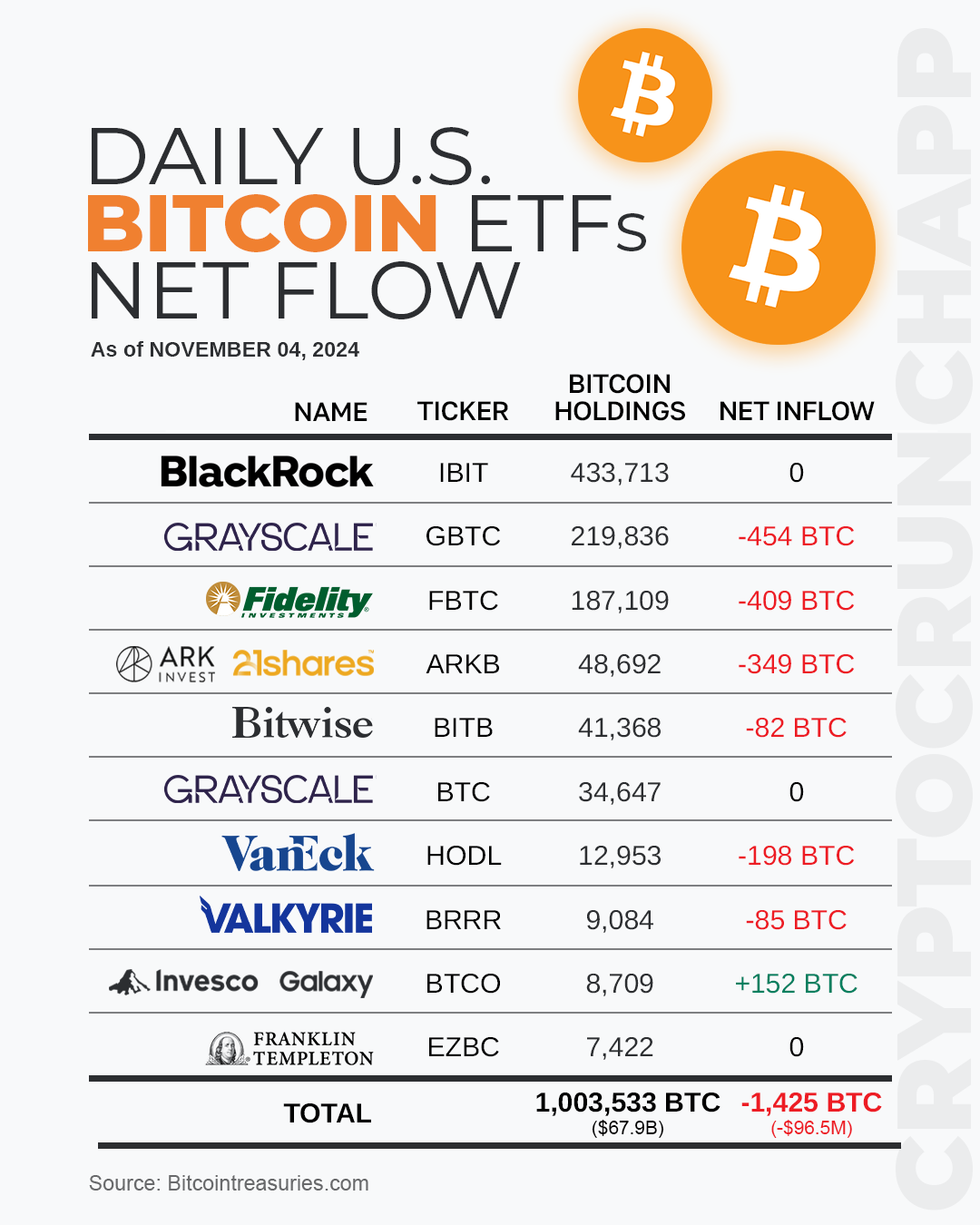

On November 4, 2024, the daily net flow of U.S. Bitcoin ETFs predominantly showed a decrease across various funds, with a few exceptions. Notable outflows were observed in some of the larger ETFs, including Grayscale’s GBTC which saw a reduction of 454 BTC and Fidelity’s FBTC, which decreased by 409 BTC. ARK’s Bitcoin ETF (Ticker: ARKB) also reported a significant outflow of 349 BTC, while VanEck’s (Ticker: HODL) and Valkyrie’s (Ticker: BRRR) funds experienced smaller declines of 198 BTC and 85 BTC, respectively.

Conversely, Invesco Galaxy’s BTCO was a standout with a positive net flow, gaining 152 BTC. Bitwise’s Bitcoin ETF (Ticker: BITB) saw a modest decrease of 82 BTC, indicating a relatively stable performance compared to its peers.

Overall, the total holdings of these ETFs summed up to 1,003,533 BTC, reflecting a collective net outflow of 1,425 BTC for the day, which corresponds to a value decrease of approximately $96.5 million. This activity suggests a day of cautious trading or profit-taking across the U.S. Bitcoin ETF market.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join