1Y

...

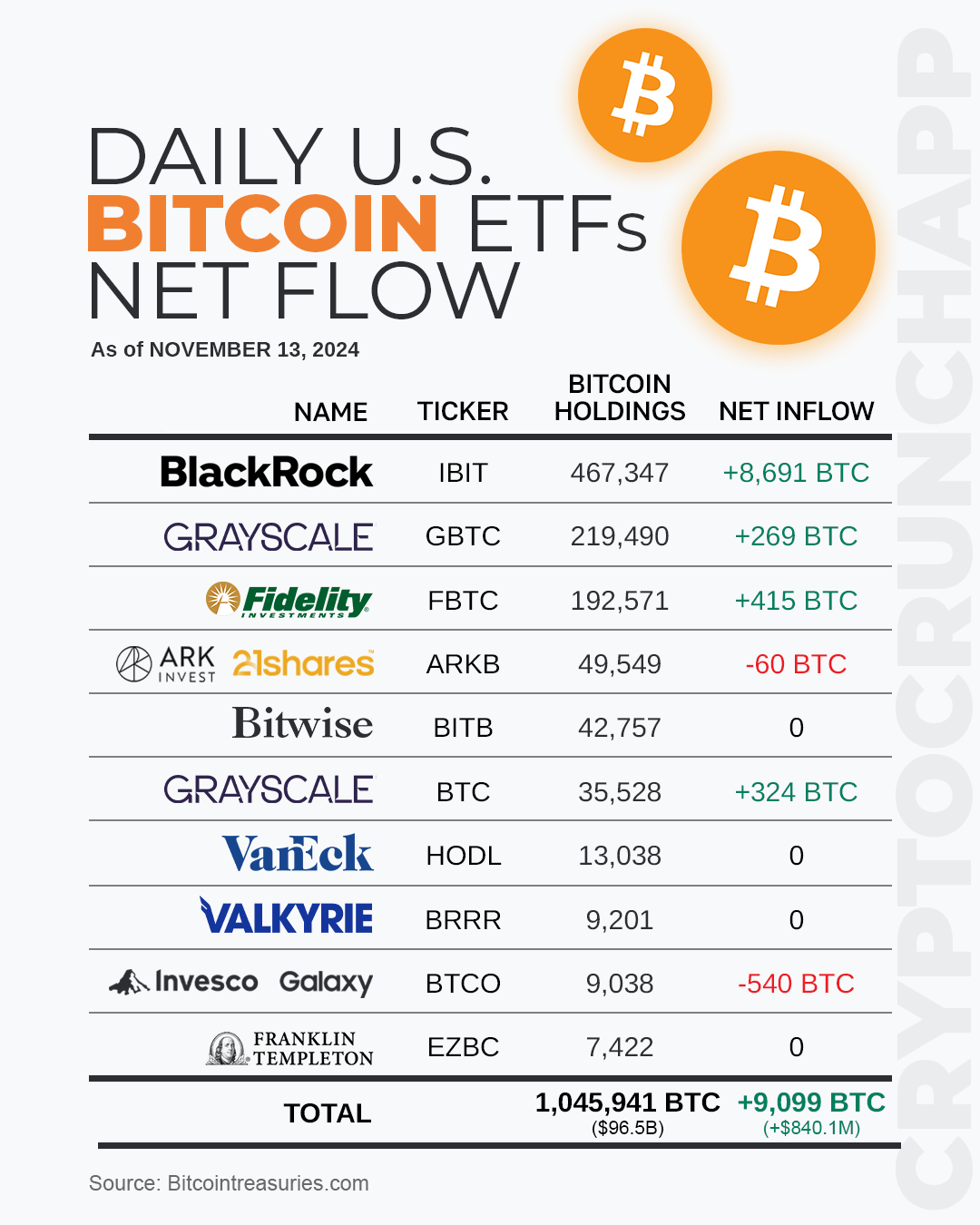

On November 13, 2024, the daily net flow of U.S. Bitcoin ETFs continued to show positive trends with a total increase of 9,099 BTC across several funds. BlackRock’s Bitcoin ETF (Ticker: IBIT) maintained a dominant performance, recording a significant net inflow of 8,691 BTC. This was complemented by Grayscale’s BTC fund (Ticker: BTC) and Fidelity’s Bitcoin ETF (Ticker: FBTC) which saw net inflows of 324 BTC and 415 BTC, respectively.

However, not all funds experienced growth; ARK’s Bitcoin ETF (Ticker: ARKB) faced a net outflow of 60 BTC, and Invesco Galaxy’s (Ticker: BTCO) saw a decrease of 540 BTC. Other ETFs like Bitwise (Ticker: BITB), VanEck’s (Ticker: HODL), Valkyrie’s (Ticker: BRRR), and Franklin Templeton’s (Ticker: EZBC) had no changes in their Bitcoin holdings for the day.

Overall, the total Bitcoin holdings of these ETFs amounted to 1,045,941 BTC, with the total net inflow contributing significantly to the market value, which increased by approximately $840.1 million. This daily activity highlights strong investor interest and significant capital inflows into certain Bitcoin ETFs, signifying robust trading dynamics in the market.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join