2Y

...

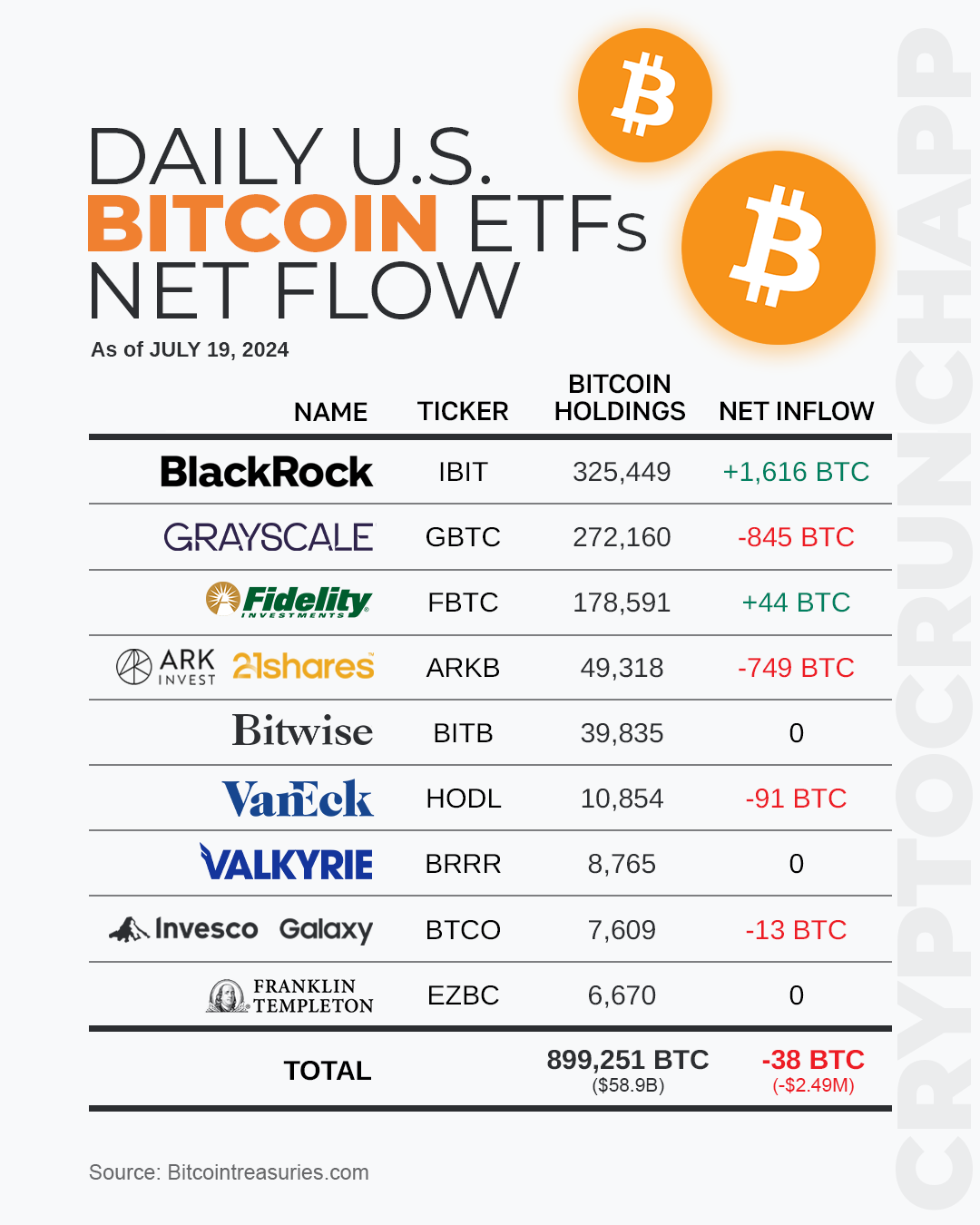

On July 19, 2024, Bitcoin ETFs in the U.S. displayed varied investment trends, reflecting dynamic market movements. BlackRock’s IBIT ETF leads the pack with 325,449 BTC and a significant net inflow of +1,616 BTC, indicating strong investor confidence. In contrast, Grayscale’s GBTC saw a net outflow of -845 BTC, highlighting a shift in investor sentiment.

Fidelity’s FBTC showed positive momentum with a modest net inflow of +44 BTC, holding a total of 178,591 BTC. Meanwhile, ARK 21Shares’ ARKB experienced a notable outflow of -749 BTC, reducing its holdings to 49,318 BTC. These mixed results underscore the diverse strategies and reactions among investors in different ETFs.

Bitwise and Valkyrie remained stable with no change in their net flows, maintaining their holdings at 39,835 BTC and 8,765 BTC, respectively. However, VanEck and Invesco Galaxy experienced slight outflows, with -91 BTC and -13 BTC respectively, suggesting cautious investor behavior.

Overall, the total holdings across these ETFs amounted to 899,251 BTC, with a minor net outflow of -38 BTC, equivalent to a monetary outflow of -$2.49 million. This snapshot provides a clear picture of current investor behavior and market sentiment in the Bitcoin ETF space.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join