2Y

...

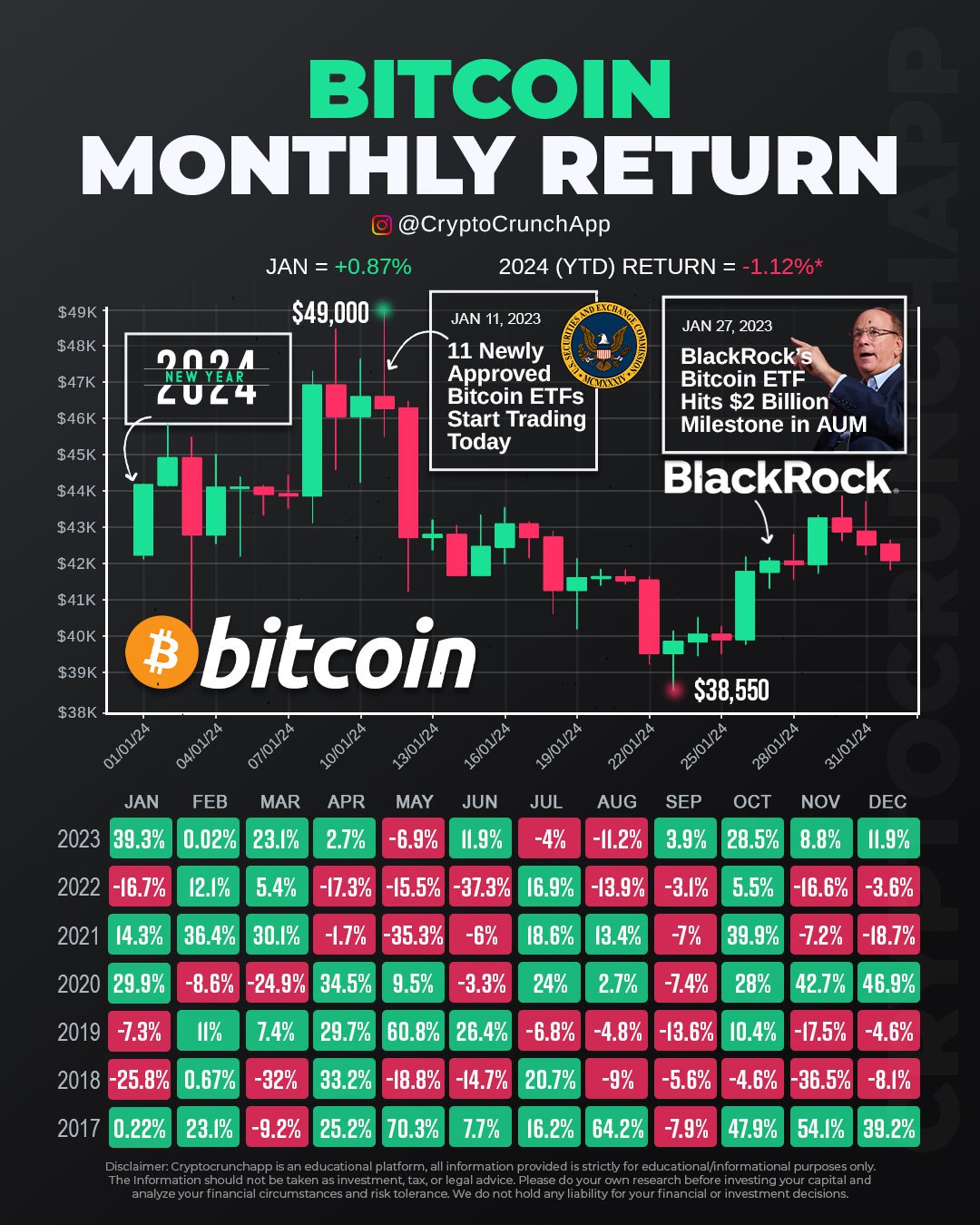

In the ever-evolving financial markets of 2024, Bitcoin has emerged as a formidable contender, showcasing its buoyancy and potential as a mainstream investment. The year kicked off with a positive adjustment in January, a modest yet meaningful 0.87% uptick in value, signaling steady investor confidence. This confidence is palpable, with the launch of 11 Bitcoin ETFs and BlackRock’s Bitcoin ETF surpassing the $2 billion mark in assets under management. Despite a marginal year-to-date retracement, Bitcoin’s historical performance narrates a tale of resilience, with impressive recoveries and consistent growth. Its ability to withstand economic headwinds positions it as a viable diversification tool, offering an alternative hedge against traditional market swings. As major financial entities weave Bitcoin into their offerings, it becomes increasingly clear that Bitcoin is not just a speculative asset but a potential staple in the investment mosaic of the future.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join