1Y

...

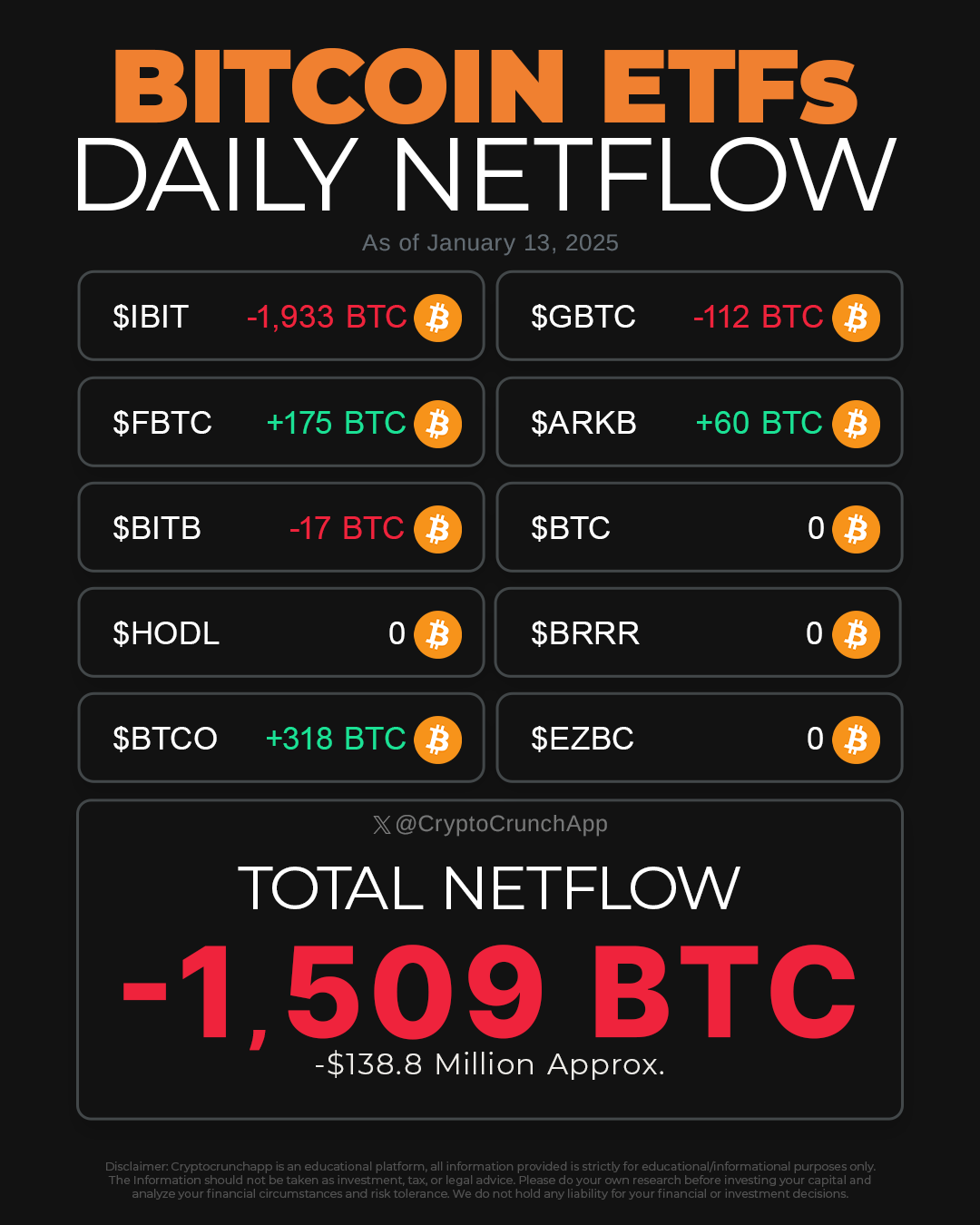

On January 13, 2025, the U.S. Bitcoin ETFs experienced a significant net outflow of 1,509 BTC, translating to approximately $138.8 million in market value. This reflects a day where several funds saw reductions, pointing to cautious trading or reallocations by investors.

BlackRock’s Bitcoin ETF (Ticker: $IBIT) faced the largest decrease, with a substantial outflow of 1,933 BTC. Grayscale’s GBTC (Ticker: $GBTC) also reported a loss, albeit smaller, with 112 BTC moving out.

On the positive side, Invesco Galaxy’s Bitcoin ETF (Ticker: $BTCO) saw the highest gain, adding 318 BTC to its holdings. Fidelity’s Bitcoin ETF (Ticker: $FBTC) also experienced a positive movement, increasing by 175 BTC, and ARK’s Bitcoin ETF (Ticker: $ARKB) gained 60 BTC.

Bitwise’s Bitcoin ETF (Ticker: $BITB) had a modest reduction of 17 BTC. Other funds such as VanEck’s (Ticker: $HODL), Valkyrie’s (Ticker: $BRRR), Grayscale’s BTC fund (Ticker: $BTC), and Franklin Templeton’s (Ticker: $EZBC) reported no change in their holdings.

This day’s net flow showcases a mix of investor actions, with significant outflows from some funds and notable inflows into others, reflecting diverse strategies and responses to market conditions.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join