2Y

...

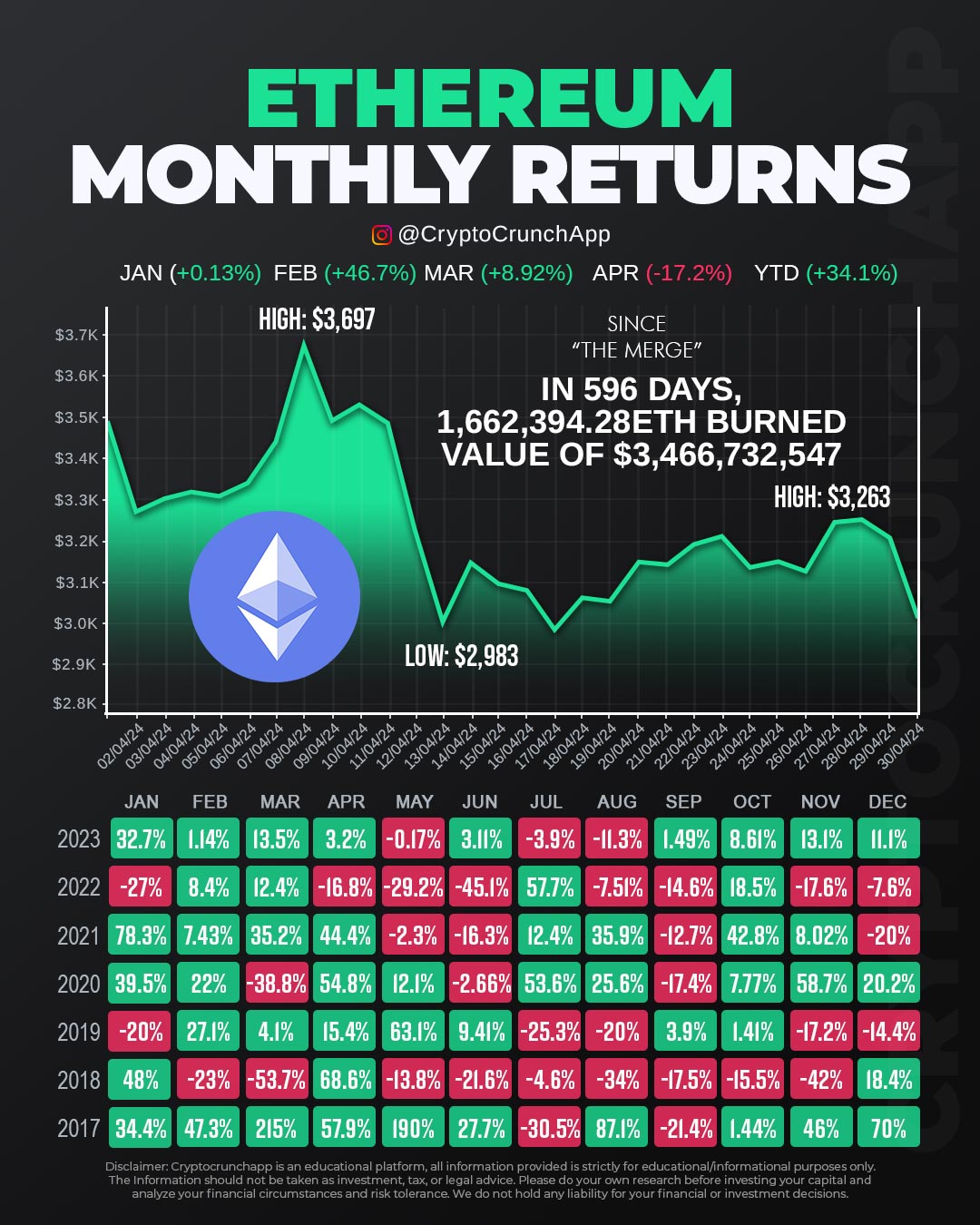

Ethereum has shown a dynamic range in its monthly returns, reflecting the volatility and growth potential of this major cryptocurrency. Starting the year with a modest increase of +0.13% in January, Ethereum saw a significant surge in February with a +46.7% increase, followed by another strong month in March with an +8.92% gain.

However, April presented a downturn with a -17.2% return, highlighting the unpredictability of crypto markets. Despite this, Ethereum’s year-to-date performance remains positive at +34.1%, indicating strong overall growth for the year.

An interesting aspect of Ethereum’s recent history is the impact of “The Merge,” the transition to a proof-of-stake consensus mechanism. Since “The Merge,” a staggering 1,662,394.28 ETH have been burned, amounting to a value of approximately $3.4 billion. This has implications for Ethereum’s supply dynamics and potentially its price stability and inflation rates.

These fluctuations in monthly returns and the strategic developments in its blockchain technology underscore Ethereum’s evolving nature and the significant interest it garners from investors looking to capitalize on the innovations within the crypto space.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join