1Y

...

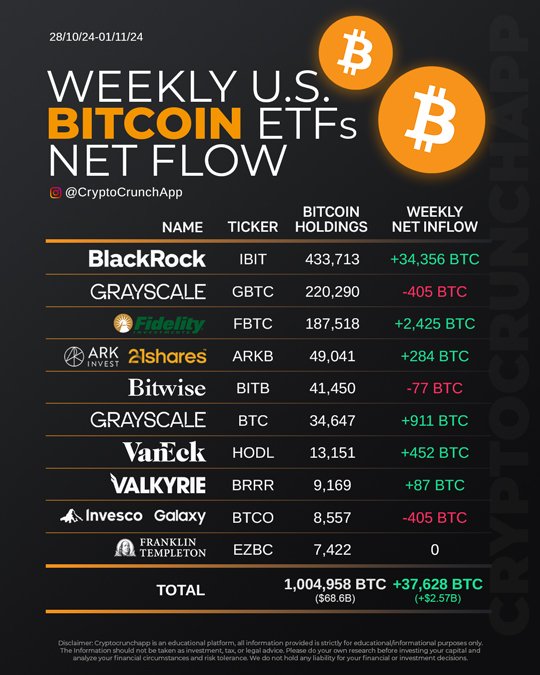

Digital asset investment products celebrated a staggering $2.2 billion in inflows last week, pushing 2023’s total to an unprecedented $29.2 billion. This surge, spurred by anticipation of a potential Republican victory in US elections, underscores a growing investor confidence in cryptocurrencies. Bitcoin led the charge with the majority of the inflows, while Ethereum and Solana also saw notable increases. The total assets under management (AuM) have now soared past $100 billion, revisiting the peak levels of early June 2024.

The US dominated these inflows, capturing $2.2 billion, with Germany also contributing. Despite a slight retreat in investment at week’s end due to shifting poll results, the overall market activity remained vigorous. Trading volumes leaped by 67% week-over-week, emphasizing the robust market dynamics currently at play.

Interestingly, while Bitcoin continued to attract the lion’s share of capital, alternative coins like Solana and Polkadot also experienced gains. Ethereum’s modest inflow of $9.5 million reflects a more cautious investor sentiment towards it, in stark contrast to the more bullish trends surrounding other major cryptocurrencies. This week’s financial movements highlight the significant impact of political events on cryptocurrency markets.