2Y

...

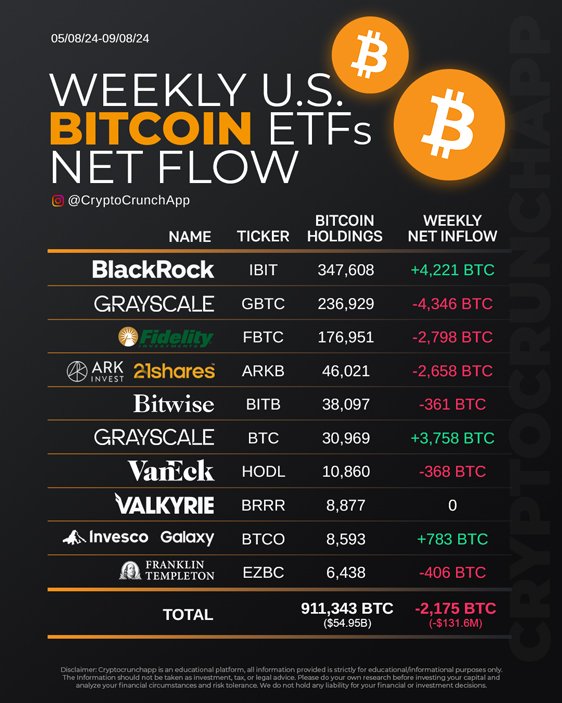

During the week of August 5 to August 9, 2024, the net flow of Bitcoin in U.S. ETFs saw a mix of inflows and outflows across different funds. BlackRock’s IBIT ETF led the way with a strong net inflow of +4,221 BTC, bringing its total holdings to 347,608 BTC, indicating significant investor confidence.

However, Grayscale’s GBTC faced substantial outflows, with a net decrease of -4,346 BTC, and Fidelity’s FBTC also saw a significant outflow of -2,798 BTC. ARK Invest’s ARKB ETF recorded a net outflow of -2,658 BTC, further contributing to the overall negative sentiment for the week.

On the positive side, Grayscale’s BTC fund showed a robust inflow of +3,758 BTC, suggesting targeted investor interest. Invesco Galaxy’s BTCO ETF also experienced a net inflow of +783 BTC.

Despite these positive movements, the overall weekly net flow for U.S. Bitcoin ETFs resulted in a net outflow of -2,175 BTC, equivalent to a value decrease of approximately $131.6 million. This week’s data reflects a complex landscape with divergent investor behavior across different ETFs, highlighting both areas of growth and caution in the market.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join