1Y

...

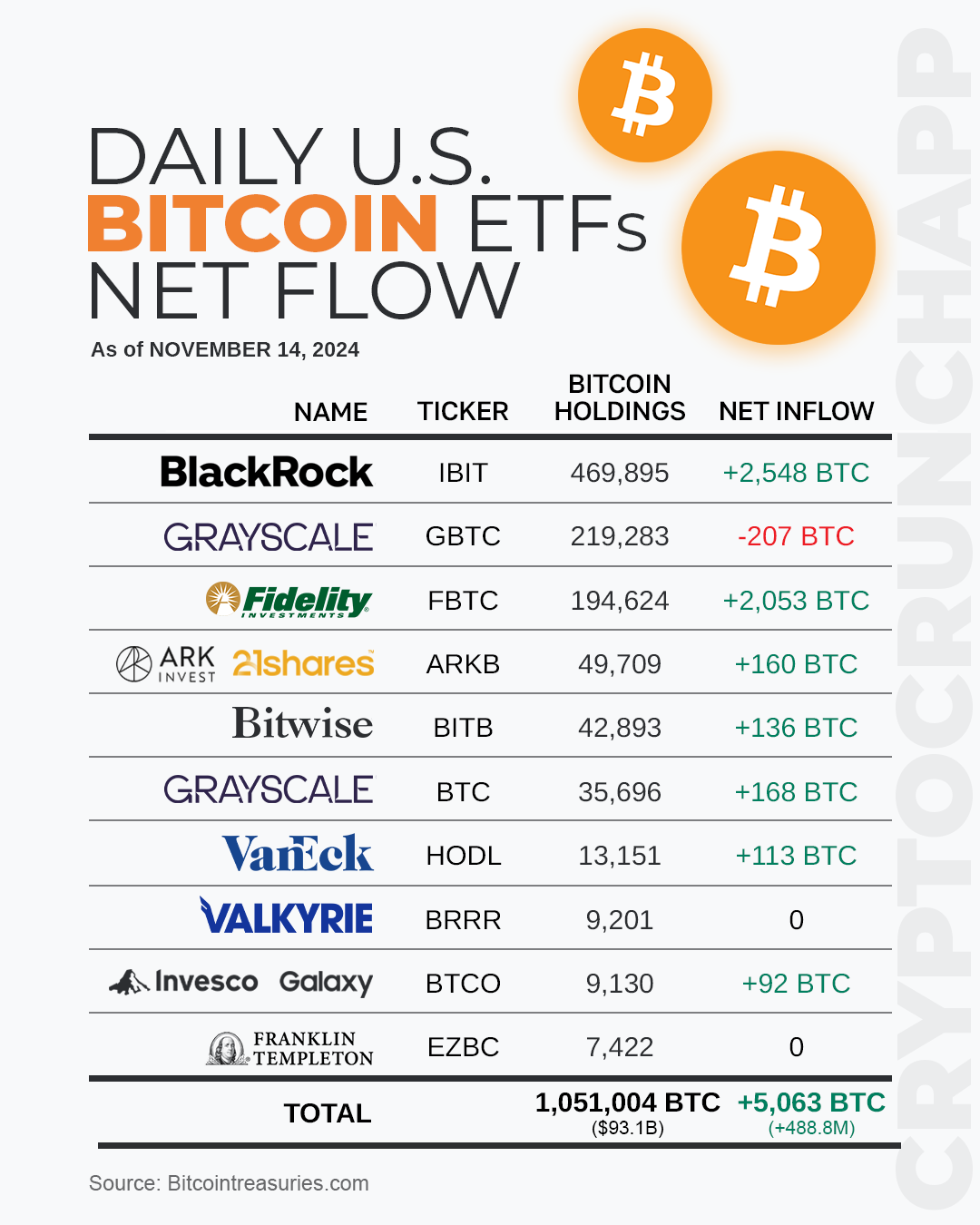

On November 14, 2024, the U.S. Bitcoin ETFs exhibited a strong positive net flow overall, indicating active investor participation and bullish market sentiments. BlackRock’s Bitcoin ETF (Ticker: IBIT) saw a notable inflow, adding 2,548 BTC to its holdings, while Fidelity’s Bitcoin ETF (Ticker: FBTC) also experienced a significant increase with an additional 2,053 BTC.

Other funds recorded positive inflows as well; ARK’s Bitcoin ETF (Ticker: ARKB) gained 160 BTC, Bitwise (Ticker: BITB) added 136 BTC, Grayscale’s BTC fund (Ticker: BTC) saw an increase of 168 BTC, and VanEck’s (Ticker: HODL) garnered an extra 113 BTC. Invesco Galaxy’s (Ticker: BTCO) also reported a smaller gain of 92 BTC.

However, Grayscale’s GBTC (Ticker: GBTC) faced a net outflow, decreasing by 207 BTC, while Valkyrie’s (Ticker: BRRR) and Franklin Templeton’s (Ticker: EZBC) holdings remained unchanged.

The total holdings across these ETFs reached 1,051,004 BTC, reflecting a substantial net daily increase of 5,063 BTC, equivalent to approximately $488.8 million in market value. This activity underscores a day marked by significant capital inflows and investor optimism in the Bitcoin ETF space.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join