1Y

...

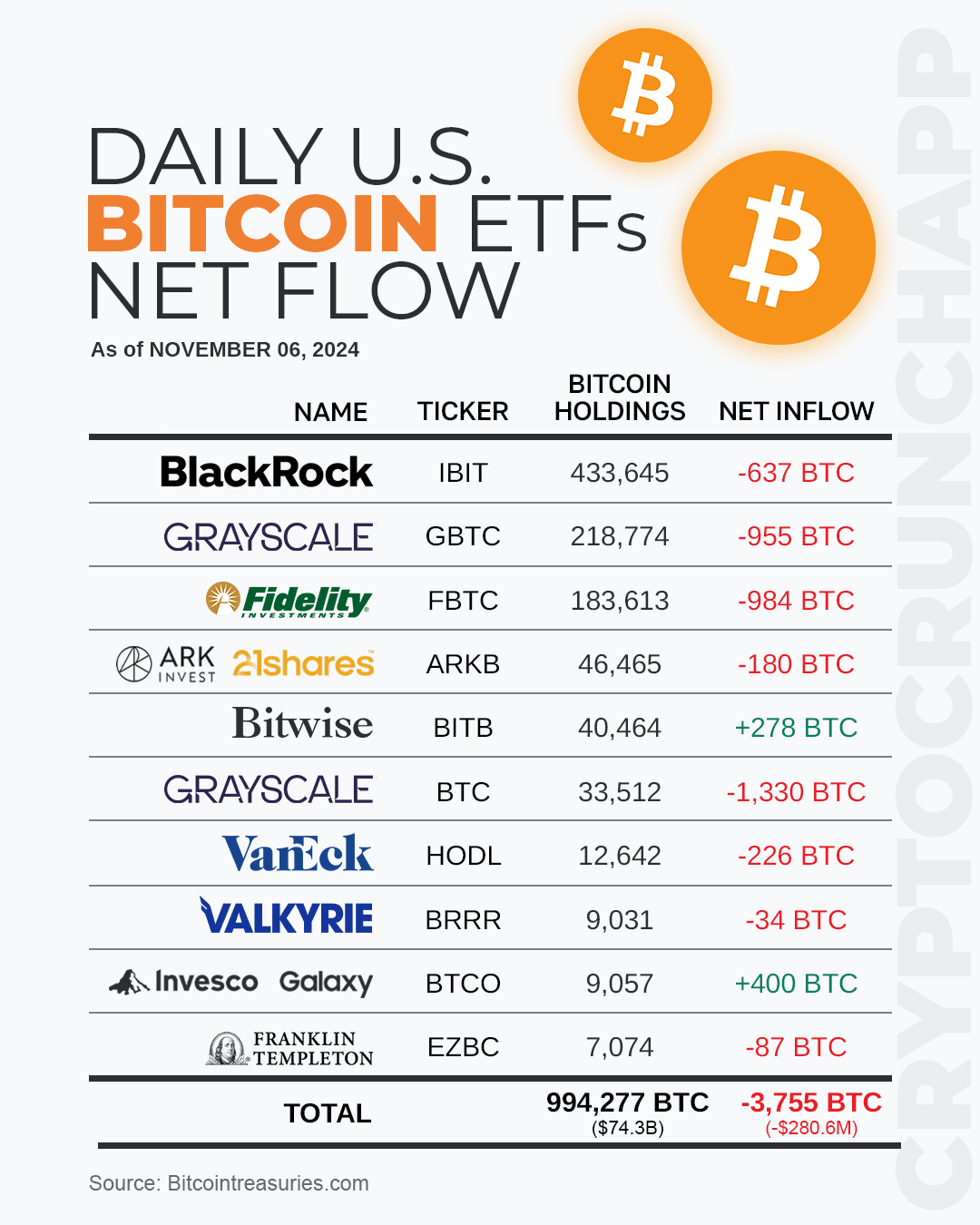

On November 6, 2024, the daily net flow of U.S. Bitcoin ETFs indicated a predominantly negative trend, with several major funds experiencing substantial outflows. BlackRock’s Bitcoin ETF (Ticker: IBIT) saw a significant decrease, losing 637 BTC from its holdings. Similarly, Grayscale’s Bitcoin Trust (Ticker: GBTC) and Fidelity’s Bitcoin ETF (Ticker: FBTC) reported reductions of 955 BTC and 984 BTC, respectively. These movements contributed heavily to the day’s overall net outflow.

Other funds also faced declines, including Grayscale’s other product (Ticker: BTC), which shed 1,330 BTC, and VanEck’s ETF (Ticker: HODL) which decreased by 226 BTC. However, there were some exceptions to the downward trend; Bitwise’s Bitcoin ETF (Ticker: BITB) had a net inflow of 278 BTC, and Invesco Galaxy’s ETF (Ticker: BTCO) gained 400 BTC, suggesting selective investor interest in these offerings.

Overall, the collective holdings across all listed ETFs totaled 994,277 BTC, with a net outflow of 3,755 BTC for the day, amounting to a loss in market value of approximately $280.6 million. This highlights a day marked by cautious or profit-taking behaviors among investors within the U.S. Bitcoin ETF sector.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join