1Y

...

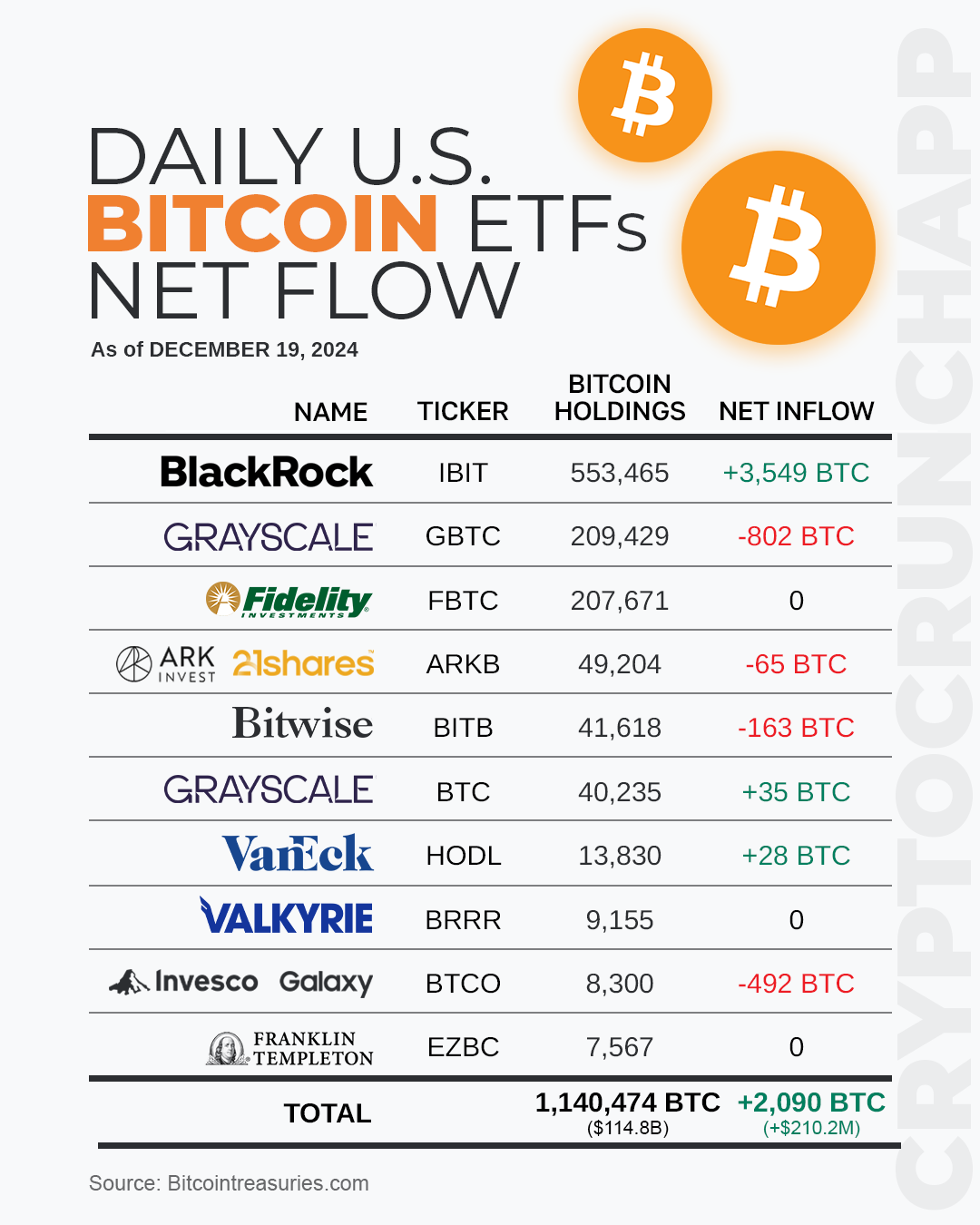

On December 19, 2024, the daily net flow of U.S. Bitcoin ETFs showed a mixed pattern of inflows and outflows across various funds. BlackRock’s Bitcoin ETF (Ticker: IBIT) led with a substantial net inflow, adding 3,549 BTC to its holdings, indicating strong investor confidence. In contrast, Grayscale’s GBTC (Ticker: GBTC) saw a significant net outflow of 802 BTC.

Other funds also experienced changes; Grayscale’s BTC fund (Ticker: BTC) gained 35 BTC, and VanEck’s (Ticker: HODL) increased by 28 BTC. However, Bitwise’s Bitcoin ETF (Ticker: BITB) and ARK’s Bitcoin ETF (Ticker: ARKB) faced net outflows of 163 BTC and 65 BTC, respectively. Invesco Galaxy’s (Ticker: BTCO) reported a larger decrease, losing 492 BTC. Fidelity’s Bitcoin ETF (Ticker: FBTC), Valkyrie’s (Ticker: BRRR), and Franklin Templeton’s (Ticker: EZBC) holdings remained unchanged for the day.

Overall, the total Bitcoin holdings of these ETFs amounted to 1,140,474 BTC, with a net daily increase of 2,090 BTC, valued at approximately $210.2 million. This day’s activity underscores the dynamic trading and varied investor reactions within the Bitcoin ETF market.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join