1Y

...

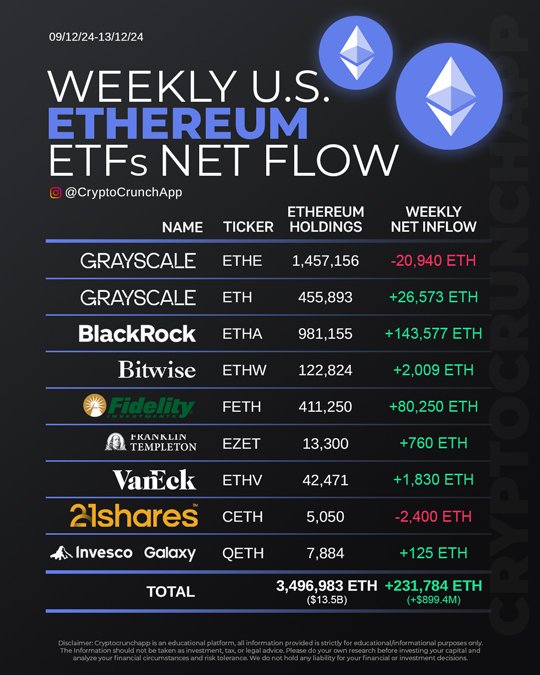

For the week spanning December 9 to December 13, 2024, the U.S. Ethereum ETFs exhibited substantial net inflows, signaling strong market participation and positive sentiment towards Ethereum. Leading the inflows, BlackRock’s Ethereum ETF (Ticker: ETHA) reported a massive increase of 143,577 ETH. Fidelity’s Ethereum ETF (Ticker: FETH) also had significant gains, adding 80,250 ETH.

Grayscale’s Ethereum ETF (Ticker: ETH), showed a robust performance as well, with a net inflow of 26,573 ETH. Additionally, Bitwise (Ticker: ETHW), VanEck (Ticker: ETHV), and Invesco Galaxy (Ticker: QETH) also experienced inflows of 2,009 ETH, 1,830 ETH, and 125 ETH respectively. Franklin Templeton’s Ethereum fund (Ticker: EZET) reported a modest gain of 760 ETH.

Conversely, Grayscale’s other Ethereum fund (Ticker: ETHE) saw a significant outflow, losing 20,940 ETH. Another fund, 21Shares (Ticker: CETH), also faced a decrease, losing 2,400 ETH.

Overall, these funds collectively held 3,496,983 ETH, marking a net increase of 231,784 ETH for the week, valued at approximately $899.4 million. This indicates a vibrant week of trading and investments in Ethereum ETFs, with the majority of funds experiencing growth in their holdings.

Disclaimer: Market capitalizations and data can vary in real-time. The information provided here is intended purely for educational purposes and should not, under any circumstances, be construed as financial advice.

Join CryptoCrunchApp on Telegram Channels – Click to Join